Long-Term Caregiving Study 2014

This is proprietary research conducted by Northwestern Mutual in 2014. Use of this information is intended for reference. Northwestern Mutual's recent proprietary research is available here.

Northwestern Mutual sponsored a study looking at how prepared Americans are when it comes to long-term care planning. The study surveyed more than 2,000 American adults 18 or older.

Download the Long-Term Caregiving Study 2014

The study revealed sobering realities regarding the state of long-term care preparedness. According to the study, 75% of Americans agree that, as people live longer, the need for LTC planning is greater, and 1 in 3 Americans are either currently providing LTC or expect to in the future. However, despite being aware of the implications of longevity, only a fraction of Americans have addressed their own care or understand their family members’ wishes regarding LTC.

Little Talk, Less Action

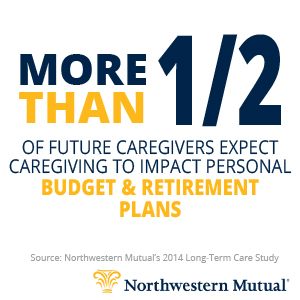

When planning for caregiving, individuals have to consider both their own needs as well as those of family members, and findings indicate that Americans are struggling with both aspects. Less than 2 in 5 consumers (37%) said their family members have shared their preferences for long-term care options with them. Additionally, more than half (56%) of future caregivers cite impact on their budgets and retirement plans as a consequence of caregiving.

- Fewer than a third (29%) have addressed the need for LTC within their own retirement plans, while just slightly more than a third (37%) claim to have discussed their own preferences for long-term care with friends and family.

- Of the 61% of respondents with an idea of how they will handle LTC, more than half (35%) are relying on their savings.

- Despite being in the sweet spot for the Sandwich Generation, a segment of the population facing the dual pressures of simultaneously supporting an elderly relative and a child under 18, only 22% of individuals aged 45-54 have addressed LTC in their retirement plans.

Women Planning at a Slower Pace

Even though women are more likely than men to believe that they will need long-term care themselves (41% vs. 35%, respectively), they are lagging behind their male counterparts in taking proactive control of LTC planning. Key findings highlighting gender differences include:

- 23% of women and 35% of men say they have addressed LTC in their retirement plan.

- 44% of women say they understand the options and resources available for planning their long-term care as compared to 53% of men.

- 39% of men are saving for their future LTC needs relative to less than a third of women (31%). Interestingly, while women are more apt than men to anticipate their friends/family will take care of them should they need LTC (22% vs. 17%, respectively), only a third (34%) have actually expressed their LTC preferences to friends and family.

Resources for Long Term Care Planning

Hear from caregivers in this video on the impact a long-term care event can have on the lives of families.

Additionally, Northwestern Mutual has a range of resources to help individuals think about and plan for long-term care needs:

- Visit the Long-Term Care Cost Calculator for a better understanding of the potential costs if you were to require long-term care services.

- Visit the Lifespan Calculator to estimate out how long you may live in retirement.

- Learn more about the long-term care costs and options available to you.

About the Research

This survey was conducted online within the United States by Harris Poll on behalf of Northwestern Mutual from September 29 – October 1, 2014, among 2,016 adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.