News Releases

MILWAUKEE, April 16, 2015 /PRNewswire/ -- April is Financial Literacy Month and the week of April 18-25 is "Money Smart Week," created to encourage Americans to improve their financial lives. One group that already has a jump-start on this is Millennials – due in part to good instincts, optimism and realistic enthusiasm, according to new findings from the 2015 Northwestern Mutual Planning & Progress Study.

"More than half of all Millennials have set financial goals, compared with only 38% of Americans age 35 and older, and 71% of Millennials are confident they'll achieve the goals they've set," said Chantel Bonneau, a 27-year old wealth management advisor with Northwestern Mutual.

Northwestern Mutual is an industry leader when it comes to cultivating healthy financial habits relevant to kids' life stages. Their website, TheMint.org, was created especially for young kids in middle-school through junior high, their teachers and parents, with kid-friendly content, activities and basic savings and financial concepts that establish healthy habits early on.

Financial Security Starts with the Basics

"We believe financial security is a life-long journey and we want to be there every step of the way – starting at the very beginning," said Bonneau. "Northwestern Mutual provides children and their care-givers with essential financial building blocks they can continue to develop as they grow older," said Bonneau.

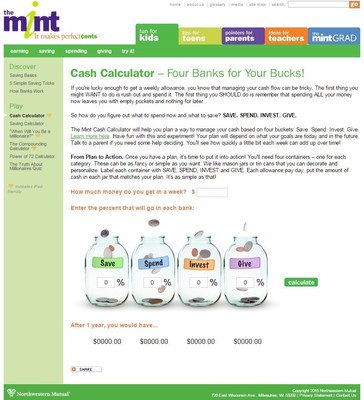

One of those building blocks is learning how to manage your money – whether a weekly allowance or cash kids earn by babysitting or mowing lawns. A brand-new tool, the Cash Calculator, launched on Mint.org just in time for Money Smart Week, helps kids learn the basics of saving, spending, investing and giving.

Financial Loving Care as Important as Health and Wellness

As kids master the basics, they grow into TheMintGrad.org, a site geared toward high school-age and current or recently graduated college students who are just starting to develop financial independence. Visitors to the site will find content suited to Millennials and their unique financial challenges and opportunities, like how to cut costs at college, how to create a monthly budget and savings tips for living a frugal – but fun – lifestyle.

"The Mint Grad is like a cool, older sibling or friend who motivates, not lectures, young adults to practice FLC – Financial Loving Care," said Bonneau. "Practicing Financial Loving Care means developing strong financial habits as part of one's overall well-being, and spending as much time and energy on nurturing your financial health as you do on other areas of your life like eating right, dating, working out and growing your career."

User-friendly and interactive, the Mint Grad is comprised of four sections. The content, developed by leading financial gurus and hip Northwestern Mutual experts like Bonneau, covers a broad spectrum of career and lifestyle planning topics in addition to financial goal-setting:

- Learn – easy-read articles provide tips for everyday money management and career ideas

- Try It – interactive tools help users practice key concepts firsthand. Includes budget worksheets, savings calculators and financial fitness tests

- Plan (to achieve your goals) – unique self-assessments help visitors learn what factors shape their spending, saving and budgeting behaviors while developing a roadmap to accomplish their financial goals

- Socialize (about money) - community forum features blog posts, polls and fun facts from a rotating think tank of financial experts

"Our hope is that young people find these online experiences to be useful and valuable but also a space where they want to hang out with us," said Bonneau. "We want to become a go-to resource for young people who truly want to take charge of their financial futures."

About Northwestern Mutual

Northwestern Mutual has been helping families and businesses achieve financial security for nearly 160 years. Our financial representatives build relationships with clients through a distinctive planning approach that integrates risk management with wealth accumulation, preservation and distribution. With more than $230 billion in assets, $27 billion in revenues, nearly $90 billion in assets under management and more than $1.5 trillion worth of life insurance protection in force, Northwestern Mutual delivers financial security to more than 4.3 million people who rely on us for insurance and investment solutions, including life, disability and long-term care insurance; annuities; trust services; mutual funds; and investment advisory products and services.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company, Milwaukee, WI, and its subsidiaries. Northwestern Mutual and its subsidiaries offer a comprehensive approach to financial security solutions including: life insurance, long-term care insurance, disability income insurance, annuities, investment products, and advisory products and services. Subsidiaries include Northwestern Mutual Investment Services, LLC, broker-dealer, registered investment adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Management Company, limited purpose federal savings bank; and Northwestern Long Term Care Insurance Company.

Photo - http://photos.prnewswire.com/prnh/20150416/199165

Photo - http://photos.prnewswire.com/prnh/20150416/199167

SOURCE Northwestern Mutual