Planning & Progress Study 2022

The 2022 Planning & Progress Study, an annual research study from Northwestern Mutual, explores U.S. adults’ attitudes and behaviors toward money, financial decision-making, and the broader issues impacting people’s long-term financial security.

More than two years into the pandemic, Americans have adapted to a new normal in their financial lives – they’ve improved their financial habits and expect them to stick; they’ve accounted for emergencies and risks; and they have far more confidence in themselves than the economy. That said, financial discipline isn’t at the level it was last year and personal savings have started to dwindle.

These are some of the findings from the 2022 Planning & Progress Study, an annual research report commissioned by Northwestern Mutual that explores Americans’ attitudes and behaviors toward money, financial decision-making and broader issues impacting their long-term financial security.

The study finds that over 60% of US adults say the pandemic has been highly disruptive to the way they manage their finances. Among them, a significant majority (48%) say they have been able to adapt while 13% say they have not.

Ground Has Been Recovered but Savings Are Beginning to Dwindle

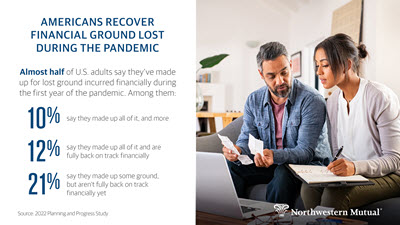

More than four in ten (43%) US adults say they made up for lost ground incurred financially during the first year of the pandemic, compared to 30% who say they haven’t and 27% who say they didn’t lose any ground in 2020. Among the 43% who have made up lost ground:

- 10% say they made up all of it and more, and they are now ahead of where they expected to be financially

- 12% say they made it up entirely and are fully back on track financially

- 21% say they made up some of the ground lost in 2020 but are not fully back on track financially yet

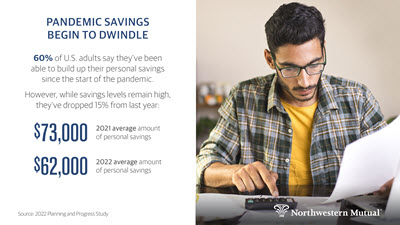

One well-documented response to the pandemic has been the impulse to save, and the 2022 Planning & Progress Study backs that up – a solid majority (60%) say they’ve been able to build up their personal savings over the last two years, and 69% of those say they plan to maintain their new saving rate going forward. That said, year-over-year numbers show that while savings levels remain high, they’ve dropped 15% from last year.

- Average amount of personal savings in 2021 – $73,000

- Average amount of personal savings in 2022 – $62,000

Better Habits and Bigger Picture Planning but Some Wavering Behaviors

Three quarters (73%) of US adults say they’ve adopted better financial habits as a result of the pandemic. Among them, an equal three quarters (73%) expect to maintain those habits going forward. While that number is relatively high, it’s below the 95% who said the same in 2021. Digging deeper, the top five behaviors adopted in 2022 underscore a commitment to discipline but at slightly lower levels than last year:

|

Top 5 Behaviors Adopted |

2021 |

2022 |

|

Reduce living costs/spending |

45% |

35% |

|

Pay down debt |

34% |

22% |

|

Increase investing |

33% |

19% |

|

Increase use of tech to manage finances |

28% |

19% |

|

Regularly revisit financial plans |

29% |

17% |

Overall, a significant number of people report taking a more comprehensive and holistic approach to their financial planning – 44% say they have adjusted to account for bigger picture emergencies and risks.

And by and large, Americans report high levels of comfort in how they manage spending and saving. The numbers jump even higher for those who get professional help:

- 71% say they have good clarity on exactly how much they can afford to spend now versus how much they should be saving for later

- 82% of people who work with an advisor have good clarity on exactly how much they can afford to spend now versus how much they should be saving for later

Confidence in Themselves, Skepticism About Most Other Things

The research finds that people have significantly greater confidence in themselves than they do in the US economy or the American Dream.

- 72% say they have had/will have a successful career

- 66% say they have achieved/will achieve long-term financial security

- 60% say they will have enough money to retire when the time comes

- 68% say their planning incorporates the possibility of unplanned emergencies

While only…

- 43% say the US economy is strong

- 35% say inflation will subside in 2022

- 56% say Social Security will be there when they need it

- 55% say the American Dream is still alive and well

When asked about their greatest obstacles to reaching financial security in retirement, people say inflation and the economy are #1 and #2. The top five include:

- Inflation – 41%

- The economy – 39%

- Lack of savings – 29%

- Personal debt – 26%

- Healthcare costs – 22%

Read the news release

Download the 2022 Planning and Progress Study – Financial Adaptation

The latest set of findings from the Northwestern Mutual 2022 Planning & Progress Study finds that people who work with a financial advisor and those who self-identify as disciplined financial planners not only report lower levels of financial anxiety in their lives, but higher levels of happiness and better sleep, too.

The research, conducted with Harris Poll and based on a sample of nearly 2,500 people, finds the majority (54%) of U.S. adults aged 18 and over report feeling somewhat or very anxious about their finances. That number drops to 46% for people who work with a financial advisor and 47% for those who self-identify as disciplined planners. It goes in the other direction for younger adults, with two-thirds (66%) of both Millennials and Gen Z saying they feel somewhat or very anxious about their finances.

|

Somewhat / very anxious about finances |

|

|

All US adults 18+ |

54% |

|

Gen Z |

66% |

|

Millennials |

66% |

|

People who work with a financial advisor |

46% |

|

People who do not work with an advisor |

58% |

|

Disciplined planners |

47% |

|

Informal planners / non-planners |

64% |

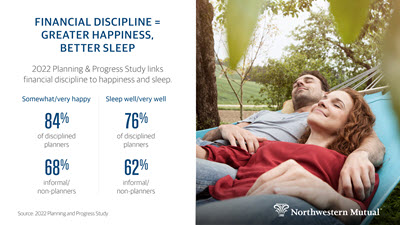

The study uncovered an interesting relationship between financial planning and overall wellness, with people who have an advisor or identify as disciplined planners reporting being happier and sleeping better.

|

Somewhat / very happy |

Somewhat / very unhappy |

|

|

Disciplined planners |

84% |

16% |

|

Informal / non-planners |

68% |

32% |

|

People who work with a financial advisor |

87% |

13% |

|

People who do not work with a financial advisor |

72% |

28% |

|

Sleep well / very well |

Sleep poorly / very poorly |

|

|

Disciplined planners |

76% |

24% |

|

Informal / non-planners |

62% |

38% |

|

People who work with a financial advisor |

81% |

19% |

|

People who do not work with a financial advisor |

65% |

35% |

A generational breakdown across wellness categories reveals that Gen X are the worst sleepers, and Millennials and Gen Z are tied for the most anxious.

|

Somewhat / very happy |

Sleep well / very well |

Not very / not at all anxious about finances |

|

|

Boomers+ |

84% |

76% |

64% |

|

Gen X |

72% |

62% |

42% |

|

Millennials |

75% |

72% |

34% |

|

Gen Z |

72% |

71% |

34% |

The study also found a strong generational difference exists when it comes to how people view the impact of their daily financial decisions. The youngest group of U.S. adults believe that small daily purchases – even a cup of coffee – will have an impact on their long-term financial security.

|

All U.S. adults |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

|

Small purchases like a daily cup of coffee will impact my long-term financial security |

44% |

53% |

52% |

46% |

32% |

|

Small purchases like a daily cup of coffee will not impact my long-term financial security |

56% |

47% |

48% |

54% |

68% |

In forthcoming data sets, the 2022 Planning & Progress Study will explore wide-ranging issues facing Americans spanning savings and debt, work and retirement, planning, priorities and more.

Download the 2022 Planning and Progress Study – Financial Wellness

More than six in 10 Americans (62%) say their financial planning needs improvement, yet only a third (35%) seek the help of a financial advisor according to the latest set of findings from the Northwestern Mutual 2022 Planning & Progress Study.

The data also revealed a more near-term trend showing a significant number of people have recognized the value of getting help over the last two years. Nearly one in five (18%) U.S. adults say they didn't have an advisor before the COVID-19 pandemic but now they either have started working with someone or plan to moving forward.

There are also some encouraging signs in the data that younger adults are valuing professional advice. Three-quarters of Gen Z and Millennials say their financial planning needs improvement. However, they are the most likely among generations to say they didn't work with an advisor before the pandemic but have since started doing so or plan to moving forward.

|

|

All US Adults 18+ |

Gen Z |

Millennials |

|

Financial planning needs improvement |

62% |

74% |

74% |

|

Work with an advisor |

35% |

30% |

40% |

|

Didn’t work with an advisor pre-pandemic but do / will now |

18% |

29% |

24% |

The study also revealed a difference in saving behaviors among people who work with an advisor versus those who go it alone. Eight in 10 (80%) people who get professional help say they were able to build their savings during the pandemic. Among people who do not work with an advisor, only half (49%) were able to save more.

The Price of Financial Uncertainty

The 2022 Planning & Progress Study found that people contending with financial uncertainty say it is impacting their health, job performance, relationships and more. They report that financial uncertainty leads to the following issues at least once a month:

- Makes them feel depressed – 36%

- Keeps them up at night – 34%

- Impacts their relationship with their spouse / partner – 28%

- Causes them to miss out on social events and opportunities – 28%

- Creates issues with friends or family (other than spouses / partners) – 26%

- Makes them physically ill – 24%

- Impacts their job performance – 24%

The study also explored levels of certainty across a broad range of factors – beyond just finances – and found people who work with an advisor feel like they’re on more solid ground across the board. When asked to rate their certainty levels on a scale of 1-100, the discrepancies were stark:

|

|

Do not work with an advisor |

Work with an advisor |

Difference of working with an advisor |

|

The stability of your current housing situation |

62.7 |

80.8 |

+18.1 |

|

Your ability to manage your level of debt |

60.6 |

80.3 |

+19.7 |

|

Your ability to afford healthcare |

57.8 |

77.7 |

+19.9 |

|

The stability of your employment situation / career |

57.2 |

76.2 |

+19 |

|

Your ability to achieve long-term financial security |

55.1 |

76.7 |

+21.6 |

|

Your ability to plan for retirement |

54.6 |

77.5 |

+22.9 |

|

Your ability to pay for an unplanned financial emergency |

52.9 |

77.6 |

+24.7 |

|

Overall certainty |

57.2 |

78 |

+20.8 |

In forthcoming data sets, the 2022 Planning & Progress Study will explore wide-ranging issues facing Americans spanning savings and debt, work and retirement, planning, priorities and more.

At the early part of this year, personal debt among U.S. adults aged 18+ was on a three-year downward trajectory, according to Northwestern Mutual’s 2022 Planning & Progress Study.

Among U.S. adults who carry debt, they held an average of $22,354 excluding mortgages in February when the research was conducted. At the time, inflation was rising but it was before the most recent spikes in the economic data. Nonetheless, the long-term trend line showed a 25% drop over three years.

|

Average Amount of Personal Debt (exclusive of mortgages) |

|

|

2019 |

$29,803 |

|

2020 |

$26,621 |

|

2021 |

$23,325 |

|

2022 |

$22,354 |

The Drag Effect

Debt can create a drag on a financial plan that can be very difficult to reverse. The research found that nearly one-third (32%) of Americans’ monthly income on average goes toward paying down debt other than mortgages.

Excluding mortgages (18%), the #1 source of personal debt by far is credit cards.

|

Sources of Personal Debt |

|

|

Credit cards |

20% |

|

Car loans |

8% |

|

Personal education loans |

8% |

|

Educational expenses for children / family members |

6% |

|

Home equity loans / lines of credit |

4% |

More than half (54%) of people say debt is having a substantial or moderate impact on their ability to reach financial security, and many Americans expect to stay in debt for a long time.

|

How Long People Expect to Be in Debt |

|

|

1-5 years |

43% |

|

6-10 years |

20% |

|

11-20 years |

12% |

|

For the rest of my life |

12% |

|

Don’t know |

13% |

Debt has also caused people to hit pause on many of life’s most meaningful milestones, including getting married, buying a house, having children and saving for retirement.

|

Things People Have Delayed as a Result of Debt |

|

|

Making a significant purchase |

31% |

|

Saving for retirement |

20% |

|

Buying a home |

18% |

|

Getting married |

8% |

|

Having children |

8% |

Americans Prioritize Paying Down Debt Over Saving

Between saving money and paying down debt, 57% of people prioritize paying down debt versus 43% who put saving first.

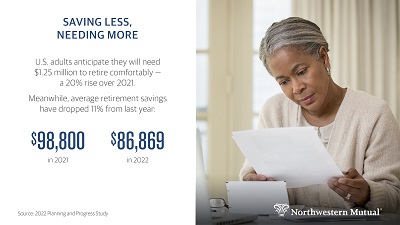

The latest findings from Northwestern Mutual’s 2022 Planning & Progress Study reveal that U.S. adults aged 18+ anticipate they will need $1.25 million to retire comfortably, a 20% rise since 2021. At the same time, Americans’ average retirement savings has dropped 11% – from $98,800 last year to $86,869 now – while their expected retirement age has risen – now 64, which is up from 62.6 last year.

Four in Ten People Don’t Think They’ll Be Ready to Retire

The study finds low levels of confidence among Americans about their retirement preparedness, and they don’t have great faith in Social Security as a backstop. More than four in ten (43%) people say they do not expect to be financially ready for retirement when the time comes. And 45% say they can imagine a time when Social Security no longer exists.

Meanwhile, one-third (33%) of Americans expect to live to 100, with an equal third (33%) predicting there is a better than 50% chance they may outlive their savings. At the same time, more than one in three (36%) report that they have not proactively taken any steps to address this concern.

|

Steps taken to address the possibility of outliving savings |

|

Percentage of overall retirement funding people expect to deliver |

||

|

Increased savings |

25% |

|

401K or other retirement account |

27% |

|

Put together a financial plan |

22% |

|

Social Security |

26% |

|

Purchased investments |

21% |

|

Personal savings or investments |

22% |

|

Discussed options with family |

18% |

|

|

|

|

Sought advice from an advisor |

18% |

|

|

|

|

Purchased insurance |

16% |

|

|

|

|

Have not taken any steps |

36% |

|

|

|

Working Longer

Americans on average plan to work until the age of 64, up from 62.6 last year. Interestingly, the study found that working with an advisor and / or being a disciplined planner can shave off a few working years – those two subgroups report anticipated retirement ages of 61 and 62 respectively.

When asked about how the pandemic has impacted people’s retirement timelines, a quarter (25%) said they plan to retire later than they had anticipated, and 15% said they plan to retire earlier. Digging into the reasons why:

|

Reasons for delaying retirement |

|

Reasons for accelerating retirement |

||

|

I want to continue to work and save money |

59% |

|

I want to spend more time with my loved ones / family |

44% |

|

I am concerned about rising costs like healthcare and / or had unexpected medical costs |

45% |

|

I have realized that my personal mission is more important than saving more for retirement |

34% |

|

I am taking care of a relative or friend / responsible for additional dependents |

26% |

|

I can afford it |

32% |

|

I had to dip into my retirement savings |

24% |

|

I want to focus on priorities / hobbies outside of work |

28% |

|

|

|

|

I was offered a buy-out / incentive to retire earlier due to the pandemic |

22% |

|

|

|

|

My work situation has changed (laid off, working remotely, etc.) |

22% |

Finally, the study also uncovered interesting data about what Americans value in their work lives, finding that most adults (60%) prioritize personal fulfillment over salary and income potential (40%) in their careers.

Download the 2022 Planning and Progress Study - Work & Retirement

The nation’s youngest adults are taking significant steps to improve their financial wellbeing with the goal of retiring at age 59 – years ahead of the generations that preceded them.

New data from Northwestern Mutual’s 2022 Planning & Progress Study revealed that Americans between the ages of 18 and 25 – known as Gen Z – were the most likely to build savings during the pandemic and begin working with an advisor. The study also showed that these young adults were more confident about their careers and in their ability to achieve financial security.

That confidence comes with caveats, however. Gen Z adults were also the most inclined to say their financial planning needs improvement. They also struggle more with mental health than any other age group.

Gen Z’s Instinct to Plan

According to Northwestern Mutual’s research, Gen Z – more than any other generation – improved their financial habits during the pandemic. Seven in 10 (70%) adults from the age group reported higher savings over that time period. They were also more likely to seek professional financial help, with nearly three in 10 (29%) saying they did not have an advisor before the pandemic but have either started working with one or plan to moving forward. Despite that, close to 75% of Gen Z adults said their financial planning needs improvement.

|

|

All U.S. adults |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

I have been able to build my savings during the pandemic. |

60% |

70% |

61% |

50% |

62% |

|

I didn't have an advisor before, but moving forward I will work with one/have started working with one |

18% |

29% |

24% |

21% |

7% |

|

My financial planning needs improvement |

62% |

74% |

74% |

69% |

41% |

Confident but Struggle with Mental Health

Gen Z had the highest levels of confidence in their careers and in their ability to achieve financial security. The research also showed that they plan to retire younger than any other generation – before the age of 60 and a full 12 years earlier than Boomers+.

|

|

All U.S. adults |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

I have had / will have a successful career |

72% |

79% |

74% |

64% |

75% |

|

I have achieved / will achieve long-term financial security |

66% |

70% |

66% |

58% |

70% |

|

Social Security will be there when I need it |

56% |

55% |

52% |

43% |

70% |

|

I expect to retire at age (mean) |

64 |

59 |

61 |

65 |

71 |

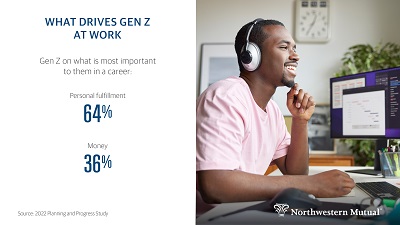

Yet, while Gen Z is looking forward to an early retirement, money is not what drives most of them at work. Nearly two-thirds (64%) said personal fulfillment is more important in a career than money (36%).

But contentment is elusive, and Gen Z’s assessment of their own mental health stands out as considerably more fragile than all other age groups. The study found that 44% of Gen Z reported their mental health as weak or very weak compared to only 26% for all U.S. adults.

|

|

All U.S. adults |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Current state of mental health is weak / very weak |

26% |

44% |

31% |

31% |

13% |