Planning & Progress Study 2021

The 2021 Planning & Progress Study, an annual research study from Northwestern Mutual, explores U.S. adults’ attitudes and behaviors toward money, financial decision-making, and the broader issues impacting people’s long-term financial security.

In just over a year, so many habits and behaviors have been transformed by the Covid-19 pandemic, and they extend well beyond social distancing, facemasks and working from home. Northwestern Mutual research finds a third (32%) of Americans say their financial discipline has improved during the pandemic, and 95% say they expect their newfound habits will stick after the health crisis subsides.

These are the first set of findings from the 2021 Planning & Progress Study, an annual research project commissioned by Northwestern Mutual that explores Americans’ attitudes and behaviors toward money, financial decision-making and broader issues impacting people’s long-term financial security.

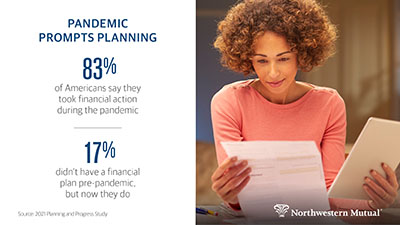

The study finds that the pandemic and related events have prompted people to get proactive with their planning. Nearly one out of five (17%) U.S. adults aged 18+ say they didn’t have a financial plan before the pandemic, but now they have one in place. Overall, 83% of people were prompted to either create, revisit, or adjust their financial plan during the pandemic.

Among the behaviors that people say they’ve adopted and expect to maintain going forward are:

- Reducing living costs/spending (e.g., cancel subscriptions, eat out less, etc.) - 45%

- Paying down debt - 34%

- Increasing investing - 33%

- Regularly revisiting financial plans - 29%

- Increasing use of tech/digital solutions to manage finances - 28%

- Increasing retirement contribution/savings - 25%

Setbacks and Postponements

Nearly half (45%) of Americans say the pandemic has impacted their timeline for achieving long-term financial security, with most saying it’s a setback of one to two years.

- 15% say it has set them back less than a year

- 18% say it has set them back 1-2 years

- 9% say it has set them back 3-5 years

- 3% say more than 5 years

For Gen Z and Millennials, it’s a majority -- 63% and 65% respectively say they’ve been set back financially. But the amount of time lost for these generations is consistent with the broader population as the most common estimation is one to two years.

Additionally, more than one-third (35%) of people have postponed a major financial or life event because of the pandemic, including:

- Making/funding large purchases or projects (home renovation, new car, etc.) - 17%

- Changing jobs/looking for a new job - 10%

- Buying or building a new home - 9%

In forthcoming data sets, the 2021 Planning & Progress Study will explore wide-ranging issues facing Americans spanning savings and debt, work and retirement, planning, priorities and more.

Download the 2021 Planning and Progress Study – COVID-19 and Financial Behavior

Most Americans are still contending with the financial impact of the Covid-19 pandemic, according to the latest set of findings from Northwestern Mutual’s 2021 Planning & Progress Study. The research finds more than half (58%) of U.S. adults aged 18+ say they are in financial recovery mode, but among them nine of out ten (89%) express confidence that they will ultimately achieve a full financial comeback.

For those in recovery, the research shows that the majority feel they are making considerable progress:

- 34% say they’re in “late-stage recovery” – they suffered losses but have mostly, if not fully, recovered to pre-pandemic levels and are feeling confident in their ability to achieve long-term financial security

- 47% say they’re in “mid-stage recovery” – they suffered losses and have begun making up ground, but have not yet reached pre-pandemic levels and still remain optimistic about their ability to achieve long-term financial security

- 18% say they’re in “early-stage recovery” – they suffered losses, are still in decline and are unclear how they’ll achieve long-term financial security

Trending in the right direction (with some caveats)

Across a range of different categories, year-over-year numbers indicate that people’s financial lives are trending in the right direction.

- Average personal savings are up over 10% -- from $65,900 last year to $73,100 today;

- Average retirement savings increased 13% -- from $87,500 last year to $98,800 today;

- Financial security is nudging upward – from an average of 6.3 on a ten-point scale last year to 6.5 today

Going a layer deeper into savings trends reveals a more nuanced story:

- A third (33%) of people say they have been able to save more over the last year;

- Nearly an equal third (31%) say they are saving less or stopped saving altogether; and

- One in ten (9%) say they’ve had to dig into savings and are going backwards.

Maintaining Momentum

The 2021 Planning & Progress Study asked people what they see as the best financial defense against future economic uncertainty and/or market volatility going forward and two replies stood out, each receiving more than three times the number of responses than any other option. Far and away, the steps that people see as their best financial defense are:

- Having an emergency fund/personal savings (30%); and

- Having a financial plan (27%)

Among the third of Americans who say they have been able to save more in the last year, they attribute it to:

- Reduced discretionary expenses (35%)

- Prioritized saving over spending (23%)

- Increased income (18%)

- Reduced living costs/necessary expenses (15%)

In a positive sign, three-quarters (74%) of people say they have good clarity on exactly how much they can afford to spend now versus how much they should be saving for later. But maintaining momentum over time will require a long-term view, and the study shows that planning horizons today are quite short.

Among the 58% of Americans who say they are in financial recovery mode, only 14% are actively planning more than five years out, while most are planning month-to-month (24%).

Download the 2021 Planning and Progress Study – Financial Recovery

According to the latest findings from Northwestern Mutual's 2021 Planning & Progress Study, U.S. adults aged 18+ say financial advisors are the most trusted source for financial advice. This represents a reversal from 2020 findings when people said they trusted themselves most.

Americans’ most trusted sources of financial advice:

| 2020 | 2021 |

| 1. Yourself (30%) | 1. Financial advisor (26%) |

| 2. Financial advisor (22%) | 2. Yourself (20%) |

| 3. Family member (13%) | 3. Spouse/partner (16%) |

Guidance through a storm

The study found that the market volatility and economic downturn caused by the Covid-19 pandemic was a major factor influencing individuals to seek out professional financial advice.

Nearly four in ten (38%) Americans currently work with a financial advisor, representing a significant jump from pre-pandemic levels (29%).

Fifteen percent of survey respondents reported that they didn’t have a financial advisor pre-pandemic and they now either currently work with an advisor or plan to start working with one.

The trend was most pronounced among younger generations, with 23% of Gen Z and an equal 23% of Millennials reporting that they have or plan to work with a financial advisor as a result of the pandemic’s impact on the markets and economy.

Financial planning priorities

When asked to identify their top financial planning priorities over the next year, respondents identified:

- Paying bills/expenses (48%)

- Saving for retirement (39%)

- Paying off debt/loans (38%)

- Taking care of family (37%)

- Investing (32%)

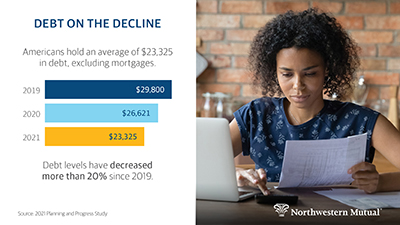

The latest findings from Northwestern Mutual’s 2021 Planning & Progress Study show that among U.S. adults aged 18+ who carry debt, they hold an average of $23,325 excluding mortgages. This represents a downward trend of over 20% since 2019.

Average Amount of Debt Per Year (exclusive of mortgages):

| 2019 | $29,800 |

| 2020 | $26,621 |

| 2021 | $23,325 |

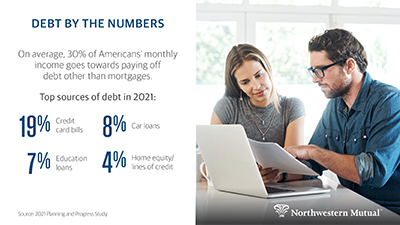

While overall debt is on the decline, 30% of Americans’ monthly income on average goes towards paying off debt other than mortgages. Far and away, the top source of debt after mortgages is credit cards, accounting for more than double any other source:

- Credit card bills - 19%

- Car loan - 8%

- Education loans - 7%

- Home equity/lines of credit - 4%

Debt under control, or controlled by debt?

With debt consuming nearly a third of monthly budgets on average, many people also say that it has negatively impacted their ability to pursue other financial milestones. Because of their debt:

- 29% delayed making significant purchases

- 18% delayed saving for retirement

- 14% delayed buying a home

- 8% delayed having children

- 7% delayed marriage

Having to pay down debt also carries weight in the way people feel about their long-term financial stability – 78% say that debt has impacted their ability to achieve long-term financial security.

Although debt is holding some back from major decisions, there are positive indications that people are looking ahead to manage and reduce their debt. Two-thirds (66%) of those with some debt say they have a specific plan to pay it off, and have a timeline for doing so:

- 45% only expect to be in debt for 1-5 years

- 20% say for the next 6-10 years

- 14% say between 11-20 years

- 9% say for the rest of their lives

The pandemic has shifted these timelines, putting some behind and giving others a chance to gain some ground. Specifically, 34% say it will take them longer than expected to pay off their debt because of the pandemic, while 23% expect to be able to pay it off sooner.

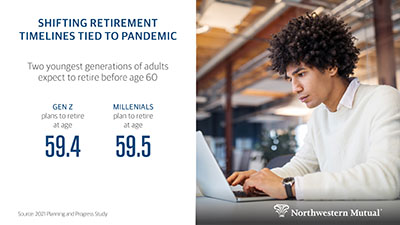

New research from Northwestern Mutual shows that Covid-19 has changed many Americans’ retirement plans, with over one-third (35%) saying it has either moved up or pushed back their target retirement age. Almost a quarter (24%) plan to retire later than previously expected while 11% plan to retire earlier.

Notably, the findings also reveal that the two youngest generations of adults expect to retire before the age of 60 – Gen Z at 59.4 and Millennials at 59.5. Overall, the average age people expect to retire is 62.6, down slightly from 63.4 last year.

Shifting Timelines

For those planning to delay retirement due to the economic impacts of the pandemic, most (39%) say they’ll push out retirement three to five years. But more than a third (35%) say their timeline for retirement has shifted back more than 10 years.

The top reasons cited for why people are delaying retirement include:

- Wanting to work and save money given additional flexibility with their workplace - 55%

- Concerns about rising costs like healthcare and/or unexpected medical costs - 50%

- Having to dip into retirement savings - 24%

- Taking care of a relative/friend; responsible for additional dependents - 14%

For those planning to retire earlier than expected, almost half (48%) say they are moving up their timeline by three to five years.

The top reasons cited for moving up their target retirement age include:

- Wanting to spend more time with their loved ones - 42%

- Focusing on hobbies/priorities outside of work - 33%

- Realizing their personal mission is more important than saving more - 29%

- Work situation has changed (laid off, etc.) - 28%

Saving More, Needing More

On average, people have $98,800 saved for retirement, up from $87,500 last year. At the same time, people’s expectations for how much they’ll need to retire comfortably is also up, from $950,800 in 2020 to $1,047,200 in 2021.

While overall retirement savings are up, more than four in 10 (43%) believe they may outlive their savings, up slightly from 41% last year.

However, the data also show that people are proactively taking steps to address this concern, including:

- Increasing savings - 29%

- Putting together a financial plan - 22%

- Discussing options with their family - 18%

- Purchasing investments - 18%

- Seeking advice from a financial advisor - 18%

When it comes to funding retirement, people plan to lean most heavily on their 401k (26.5%), Social Security (26.5%) and personal savings or investments (23.8%). However, nearly one-fifth (19%) of people say it is not at all likely that Social Security will be available to them when they retire, and 43% say they can imagine a time when Social Security no longer exists.

Download the 2021 Planning and Progress Study - Work + Retirement

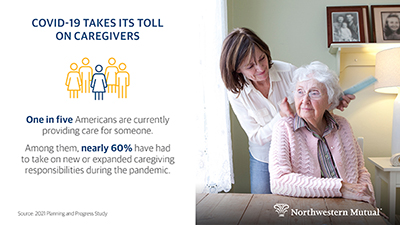

The impact of the Covid-19 pandemic has been felt especially hard among the nation’s caregivers, according to the latest findings from Northwestern Mutual’s 2021 Planning & Progress Study. One in five (21%) of Americans report they are currently providing care for someone, and among them six in ten (59%) say that they have had to take on new or expanded caregiving responsibilities during the pandemic.

The majority of caregivers (73%) report receiving help of some kind with their caregiving responsibilities, most often from family and friends:

- Family – 53%

- Friends – 25%

- Community groups – 14%

- Health care professionals – 11%

However, more than a quarter (27%) of caregivers say they do not receive any additional help.

Financial impact on caregivers

On average, nearly a third (31%) of current caregivers’ monthly budget goes toward providing care. Those costs include professional support as well as expenses for services caregivers provide themselves.

What’s less apparent in the numbers is the financial uncertainty that providing care can lead to –for example, 35% of current caregivers are not sure how much of their monthly budget goes toward providing care.

Planning for long-term care

Increased caregiving responsibilities over the last 20 months have prompted many Americans to pay more attention to long-term care. The study shows that a third (34%) of adults have planned for their own long-term care needs. Among them, more than half (53%) say the pandemic has changed their views on long-term care. As a result, they have taken specific steps toward preparing for their needs, including:

- Increasing their savings – 46%

- Incorporating long-term care into their financial plan – 39%

- Talking to their financial advisor – 37%

- Purchasing long-term care insurance – 36%