News Releases

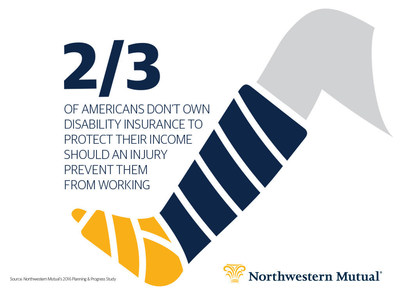

MILWAUKEE, May 4, 2016 /PRNewswire/ -- According to Northwestern Mutual's 2016 Planning & Progress Study, half of Americans rely on their job income to meet their financial obligations, yet more than two thirds (69%) do not own disability insurance to protect this integral asset in case an illness or injury interferes with their ability to work. This is concerning considering that there are one in four odds of becoming disabled for three months or more during one's working career and, per Life Happens research, nearly half of Americans would find themselves in financial trouble in a month or less after incurring a disability.

"The risk of experiencing a serious illness or injury is more common than we'd like to believe, and the impact extends way beyond the physical," said Steve Stribling, Northwestern Mutual vice president – disability income. "Our research shows that the majority of Americans (58%) view financial security as a key aspect of the American Dream. Unfortunately, a disability without income protection can quickly turn that dream into a nightmare by creating financial disruption that may take years to repair."

Disability income insurance is specifically designed to replace a significant portion of income and help with expenses and lifestyle needs if sickness or injury prevents a person from earning a living. This can help preserve an existing nest egg, provide flexibility to keep contributing to retirement savings and enable an individual to focus on their health without added financial stress.

However, despite the benefits, Northwestern Mutual research indicates that the majority of Americans (69%) do not own disability insurance and are most likely to manage the financial implications of income interruption by reducing expenses (51%) or taking money from their personal savings (35%), which can have a long-term detrimental impact.

"As life expectancies and costs increase, people are already tightening budgets and stretching savings to prepare for the possibility of an extended retirement," continued Stribling. "Disability income insurance is an easy, affordable way to relieve some of the pressure of the unexpected and keep retirement planning and other financial goals on track. Protecting the one asset that protects all other assets should be at the core of any financial plan."

May is Disability Insurance Awareness Month and an opportune time to discuss available options with a financial professional, including the differences between group policies offered by some employers and individual supplemental policies that may offer a higher level of protection and could be maintained through a job change.

NorthwesternMutual.com provides a variety of tools and educational resources, including a new Disability Insurance Calculator that analyzes individuals' current financial plans to answer the question: "What would your life be like without a paycheck?"

About The 2016 Northwestern Mutual Planning & Progress Study

The 2016 Northwestern Mutual Planning & Progress Study explores the state of financial planning in America today, and provides unique insights into people's current attitudes and behaviors toward money, goal-setting and priorities.

This study was conducted by Harris Poll on behalf of Northwestern Mutual and included 2,646 American adults aged 18 or older (2,026 interviews with U.S. adults age 18+ in the General Population and an oversample of 620 interviews with U.S. Millennials age 19-35) who participated in an online survey between February 1 and February 10, 2016. Results were weighted to Census targets for education, age/gender, race/ethnicity, region and household income. Propensity score weighting was also used to adjust for respondents' propensity to be online. No estimates of theoretical sampling error can be calculated; a full methodology is available.

For more information, please visit www.northwesternmutual.com.

About Northwestern Mutual

Northwestern Mutual has been helping families and businesses achieve financial security for nearly 160 years. Our financial representatives build relationships with clients through a distinctive planning approach that integrates risk management with wealth accumulation, preservation and distribution. With $238.5 billion in assets, $27.9 billion in revenues and more than $1.6 trillion worth of life insurance protection in force, Northwestern Mutual delivers financial security to more than 4.3 million people who rely on us for insurance and investment solutions, including life, disability income and long-term care insurance; annuities; trust services; mutual funds; and investment advisory products and services. Northwestern Mutual is recognized by FORTUNE magazine as one of the "World's Most Admired" life insurance companies in 2016.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company, Milwaukee, WI, and its subsidiaries. Northwestern Mutual and its subsidiaries offer a comprehensive approach to financial security solutions including: life insurance, long-term care insurance, disability income insurance, annuities, life insurance with long-term care benefits, investment products, and advisory products and services. Subsidiaries include Northwestern Mutual Investment Services, LLC (NMIS), broker-dealer, registered investment adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Management Company (NMWMC), federal savings bank; and Northwestern Long Term Care Insurance Company (NLTC).

Photo - http://photos.prnewswire.com/prnh/20160503/363418

Photo - http://photos.prnewswire.com/prnh/20160503/363419

SOURCE Northwestern Mutual