News Releases

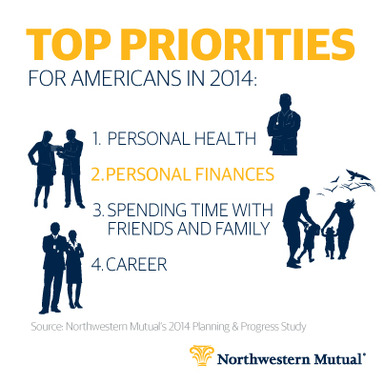

MILWAUKEE, May 28, 2014 /PRNewswire/ -- "Personal finances" and "personal health" are the top two priorities for Americans in 2014, ahead of things like "spending time with family and friends" and "career." But prioritizing appears to stop short of taking action when it comes to personal finance. While six in ten adults (60%) say their financial planning needs improvement, a large majority are not seeking professional help. Two thirds of Americans don't have a long-term financial plan and 71% do not have a financial advisor.

To view the multimedia assets associated with this release, please click http://www.multivu.com/mnr/71007511-northwestern-mutual-personal-finances-study-american-priorities

These are the latest findings from Northwestern Mutual's 2014 Planning and Progress Study, an annual research project that explores Americans' attitudes and behaviors toward finances and planning.

View the study here: http://www.northwesternmutual.com/news-room/2014PlanningandProgress.aspx#American-Priorities

According to the study, the majority (70%) of American adults feel that the economy will experience future crises, and that they need a financial plan to help them weather the ups-and-downs (52%). But only two in five agree their financial plan can withstand market cycles.

Who Uses Financial Advisors

According to the study, roughly three in ten U.S. adults choose to work with a financial advisor. A closer look at them reveals:

- They're focused – Sixty nine percent of those who use advisors consider themselves disciplined planners and 68% feel very financially secure.

- They have more grey hair – Americans aged 60 and older are three times as likely as those aged 18-29 to use an advisor (41% versus 13%).

- They have larger families – Those who are married or living with their partner are twice as likely as those not married to use an advisor (33% versus 17%), and parents are more likely to enlist the services of a professional financial advisor more often than those without children (34% versus 20%).

Staying Engaged

The Planning and Progress Study found that, among American adults who do have long-term financial plans, too many are not taking the time to revisit them to help ensure they evolve with changing needs and goals over time. For example, the study found that one in four (25%) Americans with written financial plans review them quarterly and 30% review them annually.

Executive Quotes:

Greg Oberland, Northwestern Mutual president

- "People recognize the need for improvement, yet most are choosing to make important financial decisions entirely on their own."

- "In the same way that most people wouldn't hesitate to see a doctor, or even work with a personal trainer, we believe more Americans need to see their finances in a similar light. While finance is obviously different than health, both are highly complicated and have long-term implications. As a result, expert advisors are critical."

- "Remember that financial planning is not a 'set-it-and-forget-it' exercise, and while it's encouraging that many Americans are engaged on a regular basis, I'm hopeful those numbers will increase as more people see the benefits of a disciplined approach to long-term planning," said Oberland.

About the Research

The 2014 Planning and Progress Study explores the state of financial planning in America today, and provides unique insights into people's current attitudes and behaviors toward money, goal-setting and priorities.

This study was conducted by Harris Poll on behalf of Northwestern Mutual and included 2,092 American adults aged 18 or older who participated in an online survey between January 21, 2014 and February 5, 2014. Results were weighted as needed for age by gender, education, race/ethnicity, region and household income. Propensity score weighting was also used to adjust for respondents' propensity to be online. No estimates of theoretical sampling error can be calculated; a full methodology is available.

About Northwestern Mutual

Northwestern Mutual has been helping families and businesses achieve financial security for nearly 160 years. Our financial representatives build relationships with clients through a distinctive planning approach that integrates risk management with wealth accumulation, preservation and distribution. With more than $217 billion in assets, $26 billion in revenues and more than $1.5 trillion worth of life insurance protection in force, Northwestern Mutual delivers financial security to more than 4.2 million people who rely on us for insurance and investment solutions, including life, disability and long-term care insurance; annuities; trust services; mutual funds; and investment advisory products and services.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company, Milwaukee, WI, and its subsidiaries. Northwestern Mutual and its subsidiaries offer a comprehensive approach to financial security solutions including: life insurance, long-term care insurance, disability income insurance, annuities, investment products, and advisory products and services. Subsidiaries include Northwestern Mutual Investment Services, LLC, broker-dealer, registered investment adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Management Company, limited purpose federal savings bank; Northwestern Long Term Care Insurance Company; and Russell Investments.

To view the multimedia assets associated with this release, please click http://www.multivu.com/mnr/71007511-northwestern-mutual-personal-finances-study-american-priorities

SOURCE Northwestern Mutual