2018 C.A.R.E. Study

The latest Northwestern Mutual C.A.R.E. Study found that Americans are feeling increasing financial and lifestyle pressure due to caring for an elderly relative or friend. Despite the challenges, 4 in 10 caregivers (39%) took on the role because “it is what [their] family has always done” while more than a quarter (27%) said “there was no other option.”

View the Full Size Infographic

The true cost of care

Three in ten Americans identify as current/past caregivers and more than 1 in 5 (22%) expect to become caregivers in the future. However, even though half of American caregivers (53%) say that the care event was planned, many remain unprepared for the financial implications which appear to be increasing year over year.

- While 48% of experienced caregivers say they are/were least equipped to provide financial support, 7 in 10 (68%) actually provided it

- 34% of current caregivers spend between 21-100% of their monthly budget on caregiving-related expenses; among those expenses, on average, $273 is spent on medicine/medical supplies and $159 on food

- To cover caregiving costs, 2 in 3 (67%) experienced caregivers said they reduced living expenses (significantly higher than 51% last year)

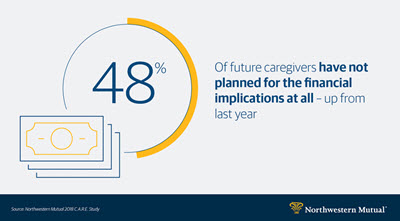

Yet, despite being aware of the financial burdens, people who believe they will provide care in the future are not taking steps to prepare. In fact, though nearly 6 in 10 (57%) future caregivers expect to incur personal costs as a function of providing care, 48% have not planned at all – a dramatic jump from 35% last year.

View the Full Size Infographic

Tough tradeoffs

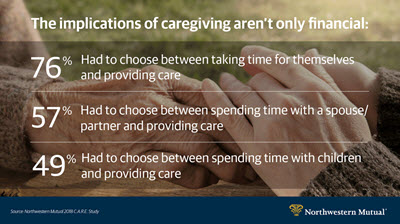

In addition to financial responsibilities, caregivers are also making substantive sacrifices in their professional and personal lives. With half of current caregivers (48%) spending between 6 and 16+ hours a day providing care, it is not surprising that 8 in 10 (85%) feel a lifestyle impact. Current caregivers “Frequently” or “Occasionally” said they have:

- 76% had to choose between taking time for themselves and providing care

- 57% had to choose between spending time with a spouse/partner and providing care

- 62% had to choose between seeing friends and providing care

- 49% had to choose between spending time with children and providing care

Caregiving has also impacted careers. 21% of experienced caregivers had to reduce work hours while 20% changed their work schedule.

View the Full Size Infographic

Preparing is caring

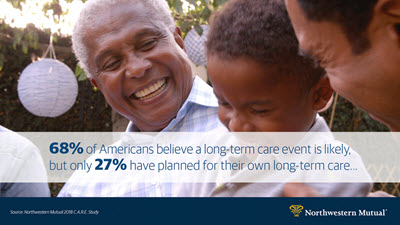

Interestingly, although Americans recognize the pervasiveness of long-term care events (more believe it is likelier to happen than outliving retirement savings or job loss), three quarters (73%) have not planned for their own long-term care needs. This gap underscores a disconnect between priorities and actions as more than half (56%) indicated that saving for long-term care is a top financial priority, ranking second after saving for retirement (68%) --- even ahead of paying off debt (55%) and saving for a home (30%).

Among those who did take steps to prepare:

- Half (52%) included provisions in their financial plan

- 4 in 10 (42%) purchased a long-term care product

- One third (35%) increased their savings

Moreover, while Americans are most likely to look to their spouse/partner (47%) or children (26%) to be their caregivers, 7 in 10 (69%) have not shared those preferences with these family members or anyone else.

View the Full Size Infographic

To learn more, visit Northwestern Mutual’s lifespan calculator and LTC cost of care calculator.

About The 2018 Northwestern Mutual C.A.R.E. Study

The 2018 Northwestern Mutual C.A.R.E. (Costs, Accountabilities, Realities, Expectations) Study explores the multiple facets of caregiving and longevity risk. This study was conducted by Harris Poll on behalf of Northwestern Mutual and included 1,004 American adults aged 18 or older from the general population, and achieved an oversample of 233 American adults age 35-49 (for a total of 413) and an oversample of 709 experienced caregivers (for a total of 987) who participated in an online survey between November 29 to December 7, 2017.

Caregiving is a growing reality for Americans – one that comes with a significant emotional toll, according to findings from Northwestern Mutual’s 2018 C.A.R.E Study. The study finds that while nine in ten caregivers say they are providing emotional support for others, significantly fewer feel they get the support they need for themselves.

According to the data, nearly half of caregivers (44%) say they only get the emotional support they need “sometimes” and more than one in ten (15%) say they don’t get adequate emotional support at all. For Gen X (age 35-50), one in four (25%) report that they don’t get adequate emotional support.

When asked why they don’t receive the level of support they need, more than half of caregivers (58%) said “they don’t share their feelings because they don’t want to burden others or be judged” while more than four in ten (42%) do not feel “people could relate.”

Gen X: Feeling Greatest Impact

Though the majority (80%) of caregivers feel “pride in doing the right thing,” that sentiment is accompanied by a range of other complex emotions. Furthermore, the emotional toll appears to be particularly pronounced for Gen X:

|

Feeling 'often' or 'all the time' |

Caregivers (total) |

Caregivers (Gen X) |

|

Tiredness |

62% |

73% |

|

Anxiety |

42% |

50% |

|

Fear |

35% |

45% |

|

Isolation |

24% |

28% |

|

Resentment |

12% |

14% |

The emotional experience of caregivers is happening in the context of the previously reported financial pressures and lifestyle impact caregivers face. Experienced caregivers report spending an average of 8.2 hours a day providing care. For Gen X, the perceived tradeoffs in their personal and professional lives are comparatively higher than for caregivers overall, which may contribute to the larger impact on their emotional and mental health.

|

How often have you had to choose between each of the following? |

Caregivers (total) |

Caregivers (Gen X) |

|

Spending money on yourself/family and care recipient (% choosing frequently/occasionally) |

53% |

59% |

|

Spending time with a spouse/partner and providing care (% choosing frequently/ occasionally) |

52% |

57% |

|

Spending time with children and providing care (% choosing frequently/occasionally) |

42% |

50% |

|

% who changed schedule at work |

17% |

19% |

|

% who reduced hours at work |

16% |

18% |

Leveraging information as one antidote to anxiety

Despite citing financial support as the most difficult aspect of providing care, few caregivers appeared to have significant awareness of resources that could potentially offset some of the stress and pressure they face.

Gen X caregivers report having “basic, minimal, or no knowledge” of Medicare (76%), Social Security (81%), and long-term care insurance (82%). This is higher than the general population which itself is also low, with 74% reporting “basic, minimal, or no knowledge” of Medicare, 68% for Social Security, and 78% for long-term care insurance.