News Releases

MILWAUKEE, June 9, 2020 /PRNewswire/ -- Market volatility and the economic downturn prompted by the COVID-19 pandemic has spurred a significant financial response among Americans and a whirl of proactivity, according to the latest findings from Northwestern Mutual's 2020 Planning and Progress Study.

For some, the crisis has led them to see the importance of having a financial plan. Among U.S. adults age 18 and older, 15% say they didn't have a plan before the pandemic but now have been prompted to develop one.

For those who already had plans in place, the crisis has prompted many to adjust course. One-fifth (20%) of Americans say they have revisited their financial plans and made significant adjustments in response to the pandemic and its subsequent economic impact.

"This is an enormously difficult time for so many Americans, however it's good to see they're taking action, rising to the challenging road ahead, and making choices aimed at enabling their recovery," says Christian Mitchell, executive vice president & chief customer officer at Northwestern Mutual. "People are doing their best to secure their financial foundations and position themselves to emerge from this stronger."

Gen X, Millennials and Gen Z are seeking help

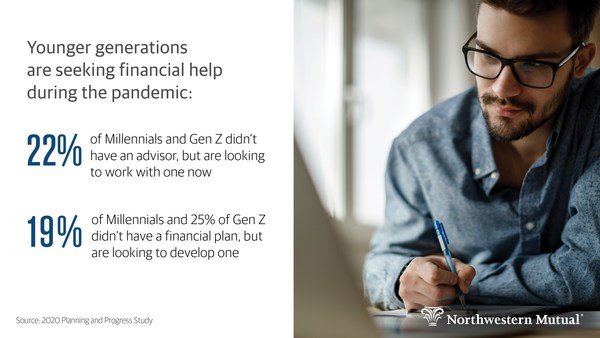

The study found that one-fifth or more of each Gen X (19%), Millennials (22%) and Gen Z (22%) say they didn't have a financial advisor before the pandemic but will seek to start working with one now.

Additionally, the younger generations stand out for how proactive they have been in response to the economic downturn:

- Nearly three out of 10 (28%) Millennials have revisited their plans and made significant adjustments, more than any other generation.

- One-fifth (19%) of Millennials and one-quarter (25%) of Gen Z didn't have a financial plan before the pandemic but are looking to develop one now.

"Generational behavior patterns often form based on experiences with economic cycles, and while this is the first downturn that Gen Z has seen, it's the second time around for many Millennials," continues Mitchell. "We're encouraged by the instinct to respond among younger people, and that many of them are seeking help from financial professionals."

Bruised but not broken

When asked how financially secure people feel on a 10-point scale, the average rating was 6.1, compared to 6.7 before the pandemic. Taking a closer look, the numbers reveal shifts at both the higher and lower ends of the scale:

- 35% rate themselves as financially secure (between an eight and 10), which is down from the 45% among these same participants who say they were financially secure prior to the pandemic.

- Those who rated themselves between one and three, or not financially secure, jumped to 19% compared to 12% pre-pandemic.

"It's understandable that most Americans feel less financially secure than they did just a short time ago," says Mitchell. "Yet we still see considerably higher numbers in the upper registers than we do in the lower, and the overall average hasn't dipped alarmingly. People's sense of financial security may be bruised but it's far from broken."

Cautious but resilient

The pandemic has had a real impact on people's financial situations, and in turn their decision-making and behaviors. Overall, Americans are showing a combination of caution and resilience in the face of adversity.

More than four in 10 (42%) Americans say they're less willing today to take risks with their finances in an effort to protect their assets, compared to just 16% who say they're more willing to take risks with their finances in an effort to pursue higher returns.

Additionally, a significant number of Americans (45%) have taken steps to cover their regular living expenses:

- 25% have dipped into personal savings or emergency funds (excluding retirement accounts)

- 14% have borrowed money from family or friends

- 10% have dipped into retirement account/savings (e.g., 401k, IRA, etc.)

- 8% have applied for a loan from a financial lender

- 8% have sold investments to raise cash (stocks, bonds, mutual funds, etc.)

- 6% have used the cash value of a life insurance policy

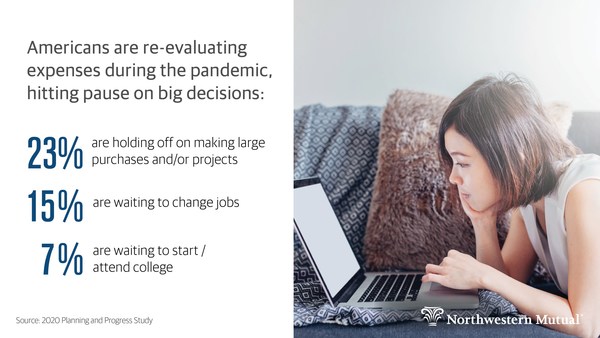

Many Americans have also re-prioritized and re-evaluated their critical vs. discretionary expenses, and hit pause on some big decisions:

- 23% have postponed large purchases or projects (e.g., car purchase, home remodeling, etc.)

- 15% have postponed changing jobs/searching for a new job

- 11% have postponed buying or building a new home

- 9% have postponed starting a business

- 7% have postponed starting / attending college

- 5% have postponed retiring / leaving the workforce

- 5% have postponed getting married

- 3% have postponed having / adopting children

Finally, the pandemic has prompted many Americans to reconsider their views of life insurance's role as part of a holistic financial plan, with nearly four in 10 (37%) saying they now see an increased importance for owning it.

"Inevitably, the pandemic will have a lasting impact on people's financial lives and our findings indicate some of the depth of the disruptions people are already facing," notes Mitchell. "However, the data also shows several hopeful signs that even when times are tough, people are generally resilient. Our reply is that we're here to help endure this difficult time and lay the groundwork for recovery – one household at a time."

About The 2020 Northwestern Mutual Planning & Progress Study

The 2020 Planning & Progress Study is a research series conducted by The Harris Poll on behalf of Northwestern Mutual. The first wave included 2,650 American adults aged 18 or older who participated in an online survey between February 12 – 25, 2020. This wave of the study included 2,077 adults aged 18 or older who participated between April 29 – May 1, 2020. Results have been weighted to Census targets for education, age/gender, race/ethnicity, region and household income. Propensity score weighting was also used to adjust for respondents' propensity to be online. No estimates of theoretical sampling error can be calculated; a full methodology is available.

About Northwestern Mutual

Northwestern Mutual has been helping people and businesses achieve financial security for more than 160 years. Through a holistic planning approach, Northwestern Mutual combines the expertise of its financial professionals with a personalized digital experience and industry-leading products to help its clients plan for what's most important. With $290.3 billion in total assets, $29.9 billion in revenues, and $1.9 trillion worth of life insurance protection in force, Northwestern Mutual delivers financial security to more than 4.6 million people with life, disability income and long-term care insurance, annuities, and brokerage and advisory services. The company manages more than $161 billion of investments owned by its clients and held or managed through its wealth management and investment services businesses. Northwestern Mutual ranks 102 on the 2020 FORTUNE 500 and is recognized by FORTUNE® as one of the "World's Most Admired" life insurance companies in 2020. Northwestern Mutual also received the highest score among individual life insurance providers in the J.D. Power 2019 U.S. Life Insurance Satisfaction Study.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM), Milwaukee, WI (life and disability insurance, annuities, and life insurance with long-term care benefits) and its subsidiaries. Subsidiaries include Northwestern Mutual Investment Services, LLC (NMIS) (securities), broker-dealer, registered investment adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Management Company® (NMWMC) (fiduciary and fee-based financial planning services), federal savings bank; and Northwestern Long Term Care Insurance Company (NLTC) (long-term care insurance).

SOURCE Northwestern Mutual