News Releases

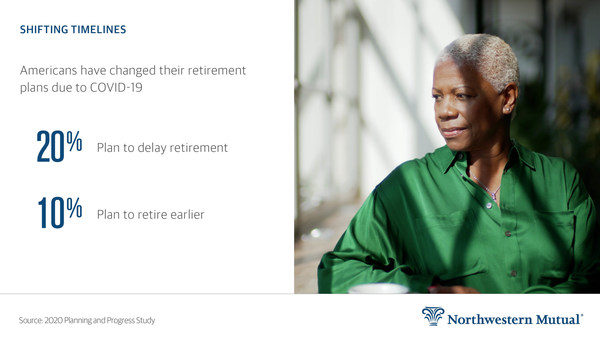

MILWAUKEE, Dec. 3, 2020 /PRNewswire/ -- The economic impact of the COVID-19 pandemic has changed the retirement timeline for 30% of Americans, according to research from Northwestern Mutual's 2020 Planning & Progress Study. The study finds that 20% of U.S. adults age 18+ plan to delay retirement beyond what they expected, while 10% plan to accelerate their timelines and retire earlier than anticipated.

Millennials are the most likely generation to move up their planned retirement date, with nearly one in six (15%) saying they would accelerate their plans. This compares to less than one in 10 among Gen Z (8%), Gen X (6%) and Boomers (4%). Meanwhile, Gen X (25%) is the most likely generation to say the pandemic has caused them to push back their planned retirement date, followed by Gen Z (22%), Millennials (19%), and Boomers (14%).

When asked what age people expect to retire, Millennials indicated the earliest target date, nearly seven and a half years younger than Baby Boomers:

- Gen Z - 62.5

- Millennials - 61.3

- Gen X - 63.2

- Boomers - 68.8

"These numbers illustrate what may be a distinct difference in the way generations view retirement," says Christian Mitchell, executive vice president & chief customer officer at Northwestern Mutual. "Millennials appear to prioritize retirement earlier on, whereas other generations may be quicker to extend their retirement timelines outward. Much of this depends on individual circumstances, of course, but it also underscores that a long-term financial plan has to factor in the unexpected and be nimble enough to adjust course."

Retirement Obstacles

The study finds that the greatest obstacles to financial security in retirement have flip-flopped during the pandemic. Before COVID-19 began to spread widely, lack of savings (42%) was the top obstacle followed by healthcare costs (38%) and the economy (34%). Now it is the economy (49%) followed by lack of savings (33%) and healthcare costs (32%).

Findings also reveal that people are relying heavily on Social Security as a funding source during retirement but don't have great faith it will actually be there when they need it. Social Security ranked as the top source of retirement funding, accounting for an average of 27% of Americans' overall retirement funding. But one-fifth (20%) of people believe it is not at all likely Social Security will be there when they're ready to use it.

"This is a good reminder that there are always factors to consider that are outside of people's control such as the economy, healthcare costs and Social Security," says Mitchell. "That only underscores how important it is to focus on the things you can control such as saving, investing and protecting your assets. A solid financial plan and a trusted advisor can help."

Working Longer

One in five (21%) U.S. adults expect to work past the traditional retirement age of 65. Among those who do, nearly half (45%) say it's because of necessity and 55% say it's because of choice.

Taking a closer look at those who plan to work out of necessity, the top reason cited was not having enough saved to retire comfortably at 60%. Other top reasons include:

- I do not feel like Social Security will take care of my needs – 58%

- I am concerned about rising costs like healthcare - 49%

- I had an unexpected situation arise that has cut into my retirement savings - 20%

For those who plan to work past the age of 65 by choice, the top reason cited by nearly half (49%) is that they enjoy their job/career and would like to continue. Other reasons include:

- I want additional disposable income - 43%

- It is a social outlet that will help me stay active/prevent boredom - 34%

- I want to do something that will let me give back to the community - 21%

"While the nature of retirement continues to change, it's encouraging to see more people working past the age of 65 out of choice and not necessity," says Mitchell. "Although that may not always be an option for all, having a tailored, diversified strategy with both insurance and investments can allow people to make informed choices regarding a retirement that suits their unique circumstances."

About The 2020 Northwestern Mutual Planning & Progress Study

The 2020 Planning & Progress Study is a research series conducted by The Harris Poll on behalf of Northwestern Mutual. This wave included 2,702 American adults aged 18 or older who participated in an online survey between June 26 – July 10, 2020. Results have been weighted to Census targets for education, age/gender, race/ethnicity, region and household income. Propensity score weighting was also used to adjust for respondents' propensity to be online. No estimates of theoretical sampling error can be calculated; a full methodology is available.

About Northwestern Mutual

Northwestern Mutual has been helping people and businesses achieve financial security for more than 160 years. Through a holistic planning approach, Northwestern Mutual combines the expertise of its financial professionals with a personalized digital experience and industry-leading products to help its clients plan for what's most important. With $290.3 billion in total assets, $29.9 billion in revenues, and $1.9 trillion worth of life insurance protection in force, Northwestern Mutual delivers financial security to more than 4.6 million people with life, disability income and long-term care insurance, annuities, and brokerage and advisory services. The company manages more than $161 billion of investments owned by its clients and held or managed through its wealth management and investment services businesses. Northwestern Mutual ranks 102 on the 2020 FORTUNE 500 and is recognized by FORTUNE® as one of the "World's Most Admired" life insurance companies in 2020.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM)(life and disability insurance, annuities, and life insurance with long-term care benefits) and its subsidiaries in Milwaukee, WI. Subsidiaries include Northwestern Mutual Investment Services, LLC (investment brokerage services), broker-dealer, registered investment adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Management Company® (investment advisory and trust services), a federal savings bank; and Northwestern Long Term Care Insurance Company.

SOURCE Northwestern Mutual