News Releases

People's 'magic number' for retirement rises faster than inflation, jumping 15% in just a year and a whopping 53% since 2020; while retirement savings falls to $88K

The 'Silver Tsunami' is here: 11,000 Americans will turn 65 every day through 2027; only half of Boomers+ and Gen X believe they'll be financially ready for retirement

Decades of Difference: Gen Z started saving at 22 and expects to retire at 60; Boomers+ started saving at 37 and expect to retire at 72

Potential for Tax Planning: As tax season continues, just 3 in 10 Americans believe they have a tax-efficient retirement plan, possibly causing many to pay more than required

MILWAUKEE, April 2, 2024 /PRNewswire/ -- Americans' "magic number" for retirement is surging to an all-time high – rising much faster than the rate of inflation while swelling more than 50% since the onset of the pandemic. These are the latest top-level findings from Northwestern Mutual's 2024 Planning & Progress Study, the company's proprietary research series that explores Americans' attitudes, behaviors and perspectives across a broad set of issues impacting their long-term financial security.

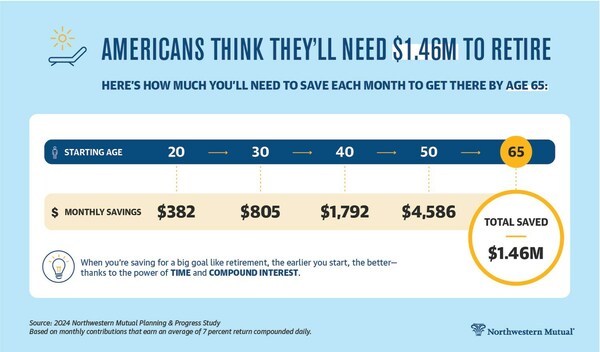

U.S. adults believe they will need $1.46 million to retire comfortably, a 15% increase over the $1.27 million reported last year, far outpacing today's inflation rate which currently hovers between 2% and 3%. Over a five-year span, people's 'magic number' has jumped a whopping 53% from the $951,000 target Americans reported in 2020.

2024 | 2023 | 2022 | 2021 | 2020 | |

Amount expected to | $1.46M | $1.27M | $1.25M | $1.05M | $951K |

By generation, both Gen Z and Millennials expect to need more than $1.6 million to retire comfortably. High-net-worth individuals – people with more than $1 million in investable assets – say they'll need nearly $4 million.

2024 | All | Gen Z | Millennials | Gen X | Boomers+ | HNW ($1M+) |

Amount expected to | $1.46M | $1.63M | $1.65M | $1.56M | $990K | $3.93M |

Meanwhile, the average amount that U.S. adults have saved for retirement dropped modestly from $89,300 in 2023 to $88,400 today, but is more than $10,000 off its five-year peak of $98,800 in 2021.

2024 | 2023 | 2022 | 2021 | 2020 | |

Amount saved for retirement currently | $88,400 | $89,300 | $86,900 | $98,800 | $87,500 |

Gap between retirement goal and current savings | $1.37M | $1.18M | $1.16M | $951K | $864K |

"In 2023, the soaring cost of eggs in the grocery store symbolized inflation in America. In 2024, it's nest eggs," said Aditi Javeri Gokhale, chief strategy officer, president of retail investments and head of institutional investments at Northwestern Mutual. "People's 'magic number' to retire comfortably has exploded to an all-time high, and the gap between their goals and progress has never been wider. Inflation is expanding our expectations for retirement savings, and putting the pressure on to plan and stay disciplined. Making a 'magic number' appear isn't about waving a wand; it's about using time-tested techniques and learning from a skilled advisor."

Across all segments, there are large gaps between what people think they'll need to retire and what they've saved to date.

All | Gen Z | Millennials | Gen X | Boomers+ | HNW ($1M+) | |

Amount saved for retirement currently | $88,400 | $22,800 | $62,600 | $108,600 | $120,300 | $172,100 |

Gap between retirement goal and current savings | $1.37M | $1.61M | $1.59M | $1.45M | $870K | $3.76M |

Gen Z: Starting sooner with the aim of ending earlier

The study finds the average age that Americans say they started saving for retirement is 31. But for Gen Z, it's 22 – nearly a decade earlier. It's also a full 15 years before Boomers+ who say they started when they were 37. Millennials and Gen X'ers began saving for retirement at ages 27 and 31, respectively.

The hope among Gen Z is that by starting to save sooner, they'll be able to retire earlier. They expect to retire at the age of 60, a dozen years before Boomers+ who say they'll work until they're 72. Millennials and Gen X'ers expect to work until 64 and 67, respectively. The average age most people expect to work to is 65.

The research discovered that three in 10 Millennials and Gen Z Americans believe it's likely or highly likely that they will live to age 100. The sentiment among these younger generations is stronger than older generations. Among Gen X and Boomers+, just 22% and 21% respectively agreed that they believed they would live to 100.

"These numbers tell a fascinating story about the profound shift in financial planning that has taken shape in America," said Javeri Gokhale. "Young people today recognize the value of retirement planning and building wealth early on in life and are getting a significant head start over their parents and grandparents. At the same time, Gen Z is redefining retirement and signaling that they plan to have long and fulfilling post-career lives. The good news is that they are investing earlier so they can save the money they need to enjoy it."

The 'Silver Tsunami' is here

In 2024, more than four million Americans will turn 65. That's an average of 11,000 Americans per day, and it will continue through 2027. It's the largest surge of Americans hitting the traditional retirement age in history.

The 2024 Planning & Progress Study found that among generations closest to retirement, just half of Boomers+ (49%) and Gen X (48%) believe they will be financially prepared when the time comes.

On average, Gen X believes there is a 42% chance they could outlive their savings, while Boomers+ put the probability at 37%. Across both generations, more than a third (37% and 38%, respectively) have not taken any steps to address the possibility of outliving their savings.

"The 'Silver Tsunami' is here," said Javeri Gokhale. "While younger generations are focused on building wealth and protecting what they've already built, Gen X and Boomers have an additional important task: paying themselves first in retirement. Where they have savings can be just as important as how much they have saved. Done well, a comprehensive financial plan can preserve thousands of hard-earned dollars to fund these golden years. For anyone who is not sure how to streamline and preserve every penny, an expert financial advisor can be a great resource."

When digging into some of the most pressing challenges associated with retirement planning, the research shows that Boomers+ and Gen X don't have markedly strong confidence in their preparedness.

Boomers+ | Gen X | |

I know how much money I will need to retire comfortably | 49 % | 40 % |

I have a plan to address healthcare costs in retirement | 56 % | 44 % |

I have planned for the possibility that I could outlive my savings | 37 % | 35 % |

I have a plan to address long-term care needs in retirement | 41 % | 34 % |

I have planned for the potential that Social Security may or may not | 39 % | 42 % |

I will have enough to leave behind an inheritance or gift to loved | 50 % | 36 % |

I have a good understanding of how taxes could impact my | 58 % | 46 % |

I have a good understanding of how potential drops in the stock | 58 % | 51 % |

Taxes are an afterthought

Only three in 10 (30%) Americans have a plan to minimize the taxes they pay on their retirement savings. Among them, the top 10 strategies employed include:

- Making withdrawals strategically from traditional and Roth accounts to remain in a lower tax bracket (32%)

- Using a mix of traditional and Roth retirement accounts (30%)

- Making strategic charitable donations (24%)

- Using a Health Savings Account (HSA) or other tax-advantaged healthcare account (23%)

- Using products like permanent life insurance or annuities for the tax benefits (22%)

- Making Roth conversions prior to taking RMDs or Social Security (19%)

- Using qualified charitable distributions from an IRA (17%)

- Making contributions to other tax-advantaged accounts like a 529 (14%)

- Using the basis paid into the cash value of permanent life insurance to remain in a lower tax bracket (13%)

- Taking advantage of a Qualified Longevity Annuity Contract (QLAC) to set aside funds for later in retirement (13%)

"Putting money into a 401K may not be enough to retire comfortably if the financial plan doesn't address the impact of taxes on retirement income," said Javeri Gokhale. "Most people don't realize that their retirement income may be taxed about 20% or 30% when they withdraw and spend it. When they recognize the impact, it's often too late for them to adjust. A comprehensive financial plan can help people get to and through retirement by minimizing exposure and preventing anyone from paying more in taxes than they should be – potentially preserving thousands of dollars in their nest eggs."

In forthcoming data sets, the 2024 Planning & Progress Study will explore wide-ranging issues facing Americans spanning savings and debt, retirement income, emerging technology, professional help and more.

About The 2024 Northwestern Mutual Planning & Progress Study

The 2024 Planning & Progress Study was conducted by The Harris Poll on behalf of Northwestern Mutual among 4,588 U.S. adults aged 18 or older. The survey was conducted online between January 3 and January 17, 2024. Data are weighted where necessary by age, gender, race/ethnicity, region, education, marital status, household size, and household income to bring them in line with their actual proportions in the population. A complete survey methodology is available.

About Northwestern Mutual

Northwestern Mutual has been helping people and businesses achieve financial security for more than 165 years. Through a comprehensive planning approach, Northwestern Mutual combines the expertise of its financial professionals with a personalized digital experience and industry-leading products to help its clients plan for what's most important. With over $627 billion of total assets[i] being managed across the company's institutional portfolio as well as retail investment client portfolios, more than $36 billion in revenues, and $2.3 trillion worth of life insurance protection in force, Northwestern Mutual delivers financial security to more than five million people with life, disability income and long-term care insurance, annuities, and brokerage and advisory services. Northwestern Mutual ranked 111 on the 2023 FORTUNE 500 and was recognized by FORTUNE® as one of the "World's Most Admired" life insurance companies in 2024.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM), Milwaukee, WI (life and disability insurance, annuities, and life insurance with long-term care benefits) and its subsidiaries. Subsidiaries include Northwestern Mutual Investment Services, LLC (NMIS) (investment brokerage services), broker-dealer, registered investment adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Management Company® (NMWMC) (investment advisory and services), federal savings bank; and Northwestern Long Term Care Insurance Company (NLTC) (long-term care insurance). Not all Northwestern Mutual representatives are advisors. Only those representatives with "Advisor" in their title or who otherwise disclose their status as an advisor of NMWMC are credentialed as NMWMC representatives to provide investment advisory services.

i Includes investments and separate account assets of Northwestern Mutual as well as retail investment client assets held or managed by Northwestern Mutual.

This material is not intended as legal or tax advice. Financial Representatives do not give legal or tax advice. Taxpayers should refer to an independent tax or legal advisor

SOURCE Northwestern Mutual