Planning & Progress Study 2019

2019 marks the 10th year of the Planning & Progress Study – an annual research study from Northwestern Mutual that explores U.S. adults’ attitudes and behaviors toward money, financial decision-making, and the broader issues impacting people’s long-term financial security.

In 2009, Northwestern Mutual commissioned a study among U.S. adults aged 25+ to explore their attitudes and behaviors toward money and financial decision-making, as well as their opinions about broader ideas such as the attainability of the American Dream. The project was ultimately named the "Planning & Progress Study" and has been conducted every year for the last decade.

In 2009, Northwestern Mutual commissioned a study among U.S. adults aged 25+ to explore their attitudes and behaviors toward money and financial decision-making, as well as their opinions about broader ideas such as the attainability of the American Dream. The project was ultimately named the "Planning & Progress Study" and has been conducted every year for the last decade.

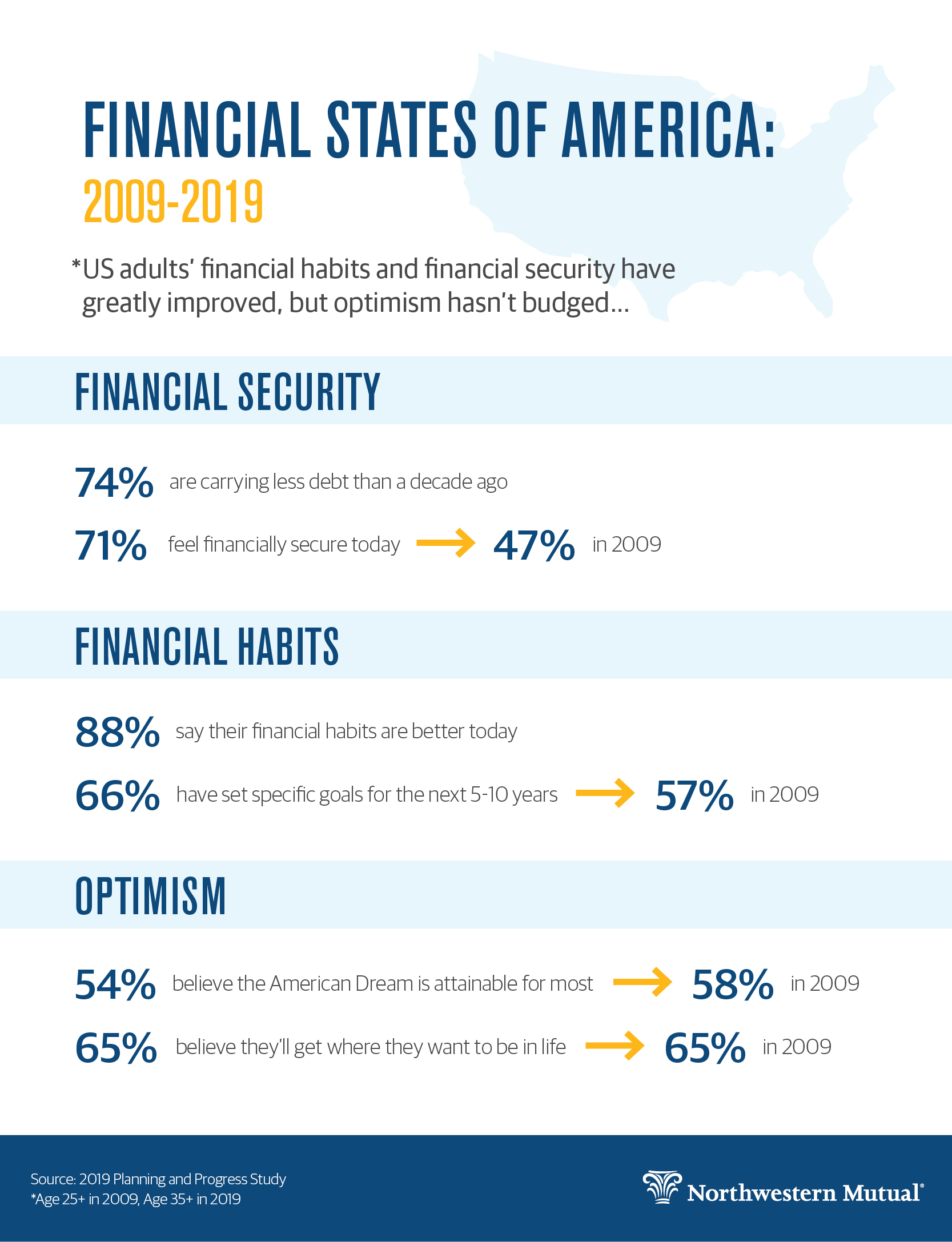

To mark the 10-year milestone of the research, the Planning & Progress Study kicks off this year with a look back at the original cohort surveyed – people who were aged 25+ in 2009 and are 35+ today. The findings reveal deep changes in their attitudes toward money and risk.

For starters, overall financial security and financial habits have markedly improved:

- 71% feel financially secure today vs. only 47% who felt financially secure in 2009

- Compared to 10 years ago:

- 73% say their financial situation is better now

- 88% say their financial habits are better

- 74% are carrying less debt

- 74% are more frugal

- 66% have set specific goals for the next 5-10 years, while only 57% said the same in 2009

Despite the stronger financial footing, Americans have gotten substantially more cautious over the last 10 years. Much of that can be pegged back to the financial crisis of 2008 – something that left a deep behavioral mark on people’s lives which extends well beyond finances.

When comparing today to how they felt during the financial crisis:

- More than one-third (37%) of adults have become less comfortable today taking financial risks vs.18% who are more comfortable

- A quarter (26%) have become less comfortable taking career risks vs.17% who are more comfortable; and

- More than one-third (35%) have become less comfortable taking risks with their healthcare coverage vs. 13% who are more comfortable

Optimism remains flat

Despite the prolonged U.S. economic recovery over the last 10 years, American optimism has remained essentially flat since 2009. Among adults age 35 and older, the study found:

- Just over half (54%) agree the American Dream is attainable for most Americans. That’s down slightly from the 58% who said the same in 2009.

- Nearly three-quarters (73%) believe a person can accomplish anything if they put their mind to it, but confidence was higher in 2009 when 82% said the same.

- Two-thirds (65%) believe they will get to where they want to be in life, which is flat to the 65% who said the same in 2009.

- A little more than one-third (36%) believe the U.S. is generally headed in the right direction, which is an uptick from the 27% who said the same in 2009. But 44% feel the U.S. is not headed in the right direction, which is slightly more than the 40% who said the same 10 years ago.

Definitions of success

The attributes that best fit people’s definition of success continue to favor relationships, health and lifestyle over material, career and wealth. The top six attributes cited in 2019 include:

- (Tie) “Spending quality time with family”

- (Tie) “Being Healthy”

- “Having a good relationship with your spouse or partner”

- “Being financially prepared for the future”

- “Having a good work/life balance”

- “Being a good parent”

Each of these far out-shadows things like “Earning a high income” (No.12), “Owning the home of your dreams” (No.11), and “Having nice belongings” (No.19).

In 2009, the answers were very similar with only slightly more priority going to work/life balance and slightly less to being financially prepared for the future. The top six attributes were:

- “Spending quality time with family”

- “Having a good relationship with your spouse or partner”

- “Being healthy”

- “Having a good work/life balance”

- “Being a good parent”

- “Being financially prepared for the future”

Here again, these attributes were cited substantially higher than “Owning the home of your dreams” (No.15), “Earning a high income” (No.16), and “Having nice belongings” (No.19).

This is the first round of findings from the 2019 Planning & Progress Study, an annual research project commissioned by Northwestern Mutual that explores Americans’ attitudes and behaviors toward money, financial decision-making, and broader issues impacting people’s long-term financial security. Future waves will explore topics such as debt, retirement, the middle class, generational differences and more.

Download the 2019 Planning and Progress Study - The Financial States of America: 2019 vs 2009

Lack of savings paints a disconcerting picture about financial preparedness in America with nearly a third (30%) of U.S. adults aged 18+ within three paychecks of needing to either borrow money or skip paying one or more bills. These are the latest findings from the 2019 Planning & Progress Study released today by Northwestern Mutual.

According to the study, more than a fifth (22%) of Americans have less than $5,000 saved for retirement, and nearly half of working adults (46%) expect to work past the traditional retirement age of 65.

The annual study found:

- More than one in five (22%) Americans have less than $5,000 saved for retirement, and 15% have no retirement savings at all. That’s an improvement from 2018 when 31% had less than $5,000 saved and 21% had no retirement savings at all.

- While 10,000 Baby Boomers turn 65 every day, nearly one in five (17%) have less than $5,000 saved for retirement and 20% have less than $5,000 in personal savings. For Gen X, the numbers are greater -- 21% have less than $5,000 saved for retirement and 22% have less than $5,000 in personal savings.

- More than half (56%) of Americans don’t know how much they’ll need to retire comfortably.

- More than a fifth (22%) of non-retired U.S. adults believe it is not at all likely that Social Security will be available when they retire.

- On average, people think there is a 45% chance they will outlive their savings, and 41% have taken no steps to address it.

When I’m 65…I’ll Still Be Working

The 2019 Planning & Progress Study found that 46% of Americans expect to work past the traditional retirement age of 65. Nearly one out of five Baby Boomers (18%) and an equal percentage of Generation X (18%) expect to work even longer -- past the age of 74.

Interestingly, more than half (53%) of Americans who expect to work past age 65 say it will be by choice, compared to 47% who say it will be out of necessity.

Among those who say they expect to work past age 65 out of necessity, the top three reasons why include:

- “I won’t have enough saved to retire comfortably” (78%)

- “I do not feel like Social Security will take care of my needs” (56%)

- “I am concerned about rising costs like healthcare” (49%)

For those expecting to work past 65 by choice, the top three reasons why include:

- “I enjoy my job/career and would like to continue” (58%)

- “I want additional disposable income” (46%)

- “It is a social outlet that will help me stay active/prevent boredom” (39%)

An Interesting Juxtaposition

The latest set of findings from the 2019 Planning & Progress Study are an interesting juxtaposition against the first set of data from the study released in May. Those results suggest that U.S. adults aged 35+ feel their financial habits and financial security have improved over the last 10 years, while risk aversion continues to run high and optimism has remained flat. It’s important to note that the sample used in the first set of findings – U.S. adults aged 35+ – is older than the sample used in this latest set of findings – U.S. adults aged 18+. For more details about the age group in the first set of findings, see the press release here.

Download the 2019 Planning and Progress Study - Work and Retirement

According to the latest findings from Northwestern Mutual's 2019 Planning & Progress Study, 92% of US adults aged 18+ agree that nothing makes them happier or more confident in life than when their finances are in order.

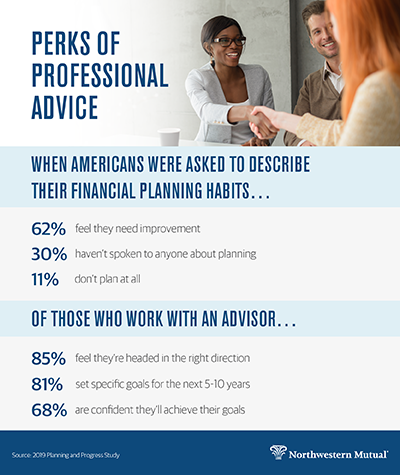

Despite the link between financial stability and emotional well-being, the majority of Americans have room for improvement when it comes to their financial planning. While there are some signs that behaviors are trending in the right direction, a gap continues to exist between intent and action:

- More than six out of ten Americans (62%) say their financial planning needs improvement, which is down from the 70% who said the same in 2018

- 59% identify themselves as either disciplined or highly disciplined planners, which is an improvement over the 49% who said the same a year ago

- Those who say they don’t plan at all is down to 11% in 2019, vs. 14% in 2018

- 30% haven’t spoken to anyone about financial planning, an improvement from the 34% who said the same a year ago

- While 64% of Americans agree there are likely to be more financial crises in the future, 20% say their retirement / financial plan has not been created to endure ups and downs in the market

- Nearly half (48%) report they don’t have clarity on how much they can afford to spend now vs. how much they should be saving for later

Advisor Usage Remains Low, but Benefits Run High

While Americans recognize that their financial planning efforts need improvement, few seek guidance from a financial professional. Only one third (31%) of US adults work with an advisor, which is flat to the proportion of the population who said the same last year.

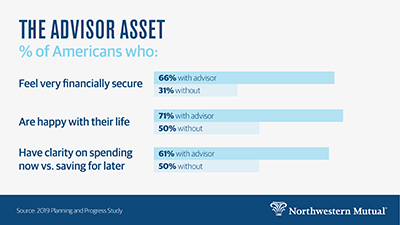

However, the benefits of seeking professional help come across distinctly in the data. Those who work with advisors report substantially greater financial security, confidence and clarity than those who go it alone:

| US Adults, Age 18+ | With Financial Advisors | Without Financial Advisors |

| Feel very financially secure | 66% | 31% |

| Feel as if they're headed in the right direction personally | 85% | 71% |

| Are happy with their life | 71% | 50% |

| Have clarity on balancing spending now vs. saving for later | 61% | 50% |

| Set specific goals for the next 5-10 years | 81% | 67% |

| Are confident they will achieve their goals in the next 5-10 years | 68% | 55% |

| Have financial plans built to endure market ups and downs | 73% | 30% |

Download the 2019 Planning and Progress Study - The Advisor Asset

The youngest generation of American adults are goal-oriented and have the desire to be self-driven, with 81% reporting they have specific goals for the next five to 10 years, according to the latest findings from Northwestern Mutual's 2019 Planning & Progress Study.

When asked how they define success, the No.1 response from Gen Z (born 1997-2012) is “enjoying your career” (45%). It's the only generation to put an enjoyable career first, coming in ahead of attributes including “spending quality time with family,” which ranked highest for Millennials and Matures, and “being healthy,” which Gen X and Boomers listed as their top attribute.

Looking forward, Gen Zers are optimistic about their prospects:

- Nearly eight in 10 (78%) believe that someday they will get to where they want to be in life, which is more than 10 percentage points higher than the general public (67%) and outranks their Millennial counterparts (75%)

- 65% are confident they will achieve their goals for the next five to 10 years, on par with Millennials and surpassing the general population (59%)

The Financially Uncertain Generation

Despite their ambition and drive, Generation Z is saddled with substantial uncertainties about their current financial status and sees significant room for improvement around how to manage money day-to-day:

- Over a quarter (28%) of Gen Z views their generation as not at all responsible when it comes to finances, which is double that of the general population (14%) and well above the percentage of Millennials who say the same (22%)

- 57% report not knowing how much money they have in savings, a significant increase from the general public (46%) and their Millennial counterparts (48%)

- Nearly seven in 10 (69%) say they don’t have great clarity on how much they can spend now vs. how much they should be saving for later

When asked to list the three things that would improve their lives the most, members of Gen Z said:

- Having more money (50%)

- Being more self-confident or self-reliant (27%)

- Doing work that you enjoy (24%)

U.S. adults aged 18+ report having an average of $29,800 in personal debt, exclusive of mortgages, according to the latest findings from Northwestern Mutual’s 2019 Planning & Progress Study. The research also revealed that 15% of Americans believe they’ll be in debt for the rest of their lives.

While those numbers are staggering, they represent an improvement over last year when U.S. adults reported an average of $38,000 in personal debt. Still, the debt problem in America continues to run deep with wide-spread implications. The study found:

- On average, over one-third (34%) of people’s monthly income goes toward paying off debt

- 45% of Americans say debt makes them feel anxiety on at least a monthly basis

- 35% report feeling guilt at least monthly as a result of the debt they’re carrying

- One in five (20%) report that debt makes them feel physically ill at least once a month

- One-fifth (20%) of U.S. adults are not sure how much debt they have

- Over one in three Americans (34%) are unsure how much of their monthly income goes toward paying off their debt

Among the generations, Gen X reported the highest levels of personal debt with $36,000 on average. They’re followed by Baby Boomers at $28,600; Millennials at $27,900; and Gen Z at $14,700.

This is the latest round of findings from the 2019 Planning & Progress Study, an annual research project commissioned by Northwestern Mutual that explores Americans’ attitudes and behaviors towards money, financial decision-making, and factors impacting long-term financial security. This year marks the 10-year anniversary of the study.

The Credit Card Crisis

The leading sources of debt for most Americans is a tie between mortgages and credit cards, according to the study. An equal 22% of U.S. adults listed each as their main source of debt, more than double the next two highest sources — car loans (9%) and personal education loans (8%).

Millennials cite credit card bills as their main source of debt (25%), while Gen Z notes personal education loans as theirs (20%). Both Gen Xers (30%) and Baby Boomers (28%) note mortgages as their leading source of debt, followed by credit card bills (at 24% and 18% respectively).

Digging deeper into the numbers around credit card debt, the study found:

- Nearly one-third of Americans (31%) are paying interest rates on their credit cards greater than 15%

- Over 1 in 10 (12%) say they “always” pay only the minimum required payment, just covering the interest without paying down any principal

- Close to one-fifth (19%) don’t know what their interest rate is, with Millennials being the most likely to report not knowing (22%)

- 18% report having four or more credit cards, with Baby Boomers being more likely than other generations to have four or more (23%)

According to the Federal Reserve Bank of New York, credit card debt has reached $868 billion in the United States, and delinquencies are on the rise.

Download the 2019 Planning and Progress Study - The Debt Debacle

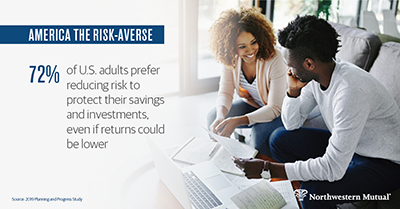

Americans are far from daredevils when it comes to how they manage their finances, careers, social lives and more. In fact, the latest findings from Northwestern Mutual’s 2019 Planning & Progress Study suggest that when U.S. adults face choices about how much risk to take on, most prefer to play things safe.

For example, when asked about their likelihood to take calculated risks with their finances, nearly three quarters (72%) of U.S. adults 18+ report they are more comfortable reducing risk to ensure the safety and stability of their savings and investments, even if it means the potential for lower returns.

Risky Business

The study found that the average American “financial risk tolerance” – defined as the comfort level with taking financial risks in order to seek financial returns – is a 4.9 out of 10 (with 1 being ‘very conservative’ and 10 being ‘very aggressive’). Considerably more people fall on the risk-averse end of the scale, with 30% in the 1-3 low-tolerance range vs 14% between 8-10.

Digging deeper into the tolerance numbers shows that individuals most comfortable with risk are those who self-identify as disciplined planners and those working with advisors:

- Americans who consider themselves ‘highly-disciplined planners’ – defined as people who know their exact goals, have developed specific plans to meet them, and rarely deviate from those plans – report a risk tolerance of 5.3. Comparatively, those who identify as ‘informal planners’ – defined as people with a general sense of their goals and how to meet them, but do not have a formal plan in place – report a risk tolerance of 4.5.

- U.S. adults who work with an advisor report a risk tolerance of 5.2, and those without advisors have a risk tolerance of 4.6.

Attitudes Towards Risk in Everyday Life

The tendency toward risk-aversion isn’t limited to finances. The study also found that Americans are more inclined to play it safe across many areas of their lives, including:

- Their careers: 65% prefer the consistency and stability of staying with one employer rather than taking the risk of moving around; 35% prefer to take the risk of making changes (e.g., employer, field, starting a business, etc.) because they believe it has a higher potential for success/happiness than inaction.

- Where they choose to live: 76% prefer the stability and consistency of living in one place long-term, even if an opportunity to move could potentially result in career growth, improved finances, etc.; 24% report they prefer the adventure of starting over and experiencing new cities, neighborhoods and people.

- The activities they enjoy: 72% say their personal interests tend toward activities that don’t involve an element of risk; 28% are thrill-seekers who like folding in an element of risk as a way of having fun – things like skydiving, swimming with sharks, climbing mountains, and bungee jumping.

- Their social lives: 66% stick close to the friends they already have, not necessarily because they’re uninterested in forming new relationships, but rather because they tend to avoid taking chances socially; 34% put themselves out there and take chances socially because they love the prospect of forming new friendships/relationships.

These are the latest findings of the 2019 Planning & Progress Study, an annual research project commissioned by Northwestern Mutual that explores Americans' attitudes and behaviors towards money, financial decision-making, and factors impacting long-term financial security. This year marks the 10-year anniversary of the study.

Download the 2019 Planning and Progress Study - America the Risk-Averse