Planning & Progress Study 2014

This is proprietary research conducted by Northwestern Mutual in 2014. Use of this information is intended for reference. Northwestern Mutual's recent proprietary research is available here.

Northwestern Mutual again explored the state of financial planning in America today to obtain insights into people's attitudes and behaviors toward money, goal-setting and priorities. The 2014 study surveyed nearly 2,100 American adults 18 or older.

Financial Discipline and Happiness in Retirement

The study showed the more discipline an individual brings to financial planning, the more financially secure he or she feels in the present, and the greater likelihood they’ll be happy in the future.

- 70% of Highly Disciplined planners feel ‘very financially secure’ vs. 51% of Disciplined planners, 34% of Informal planners and 17% of non-planners

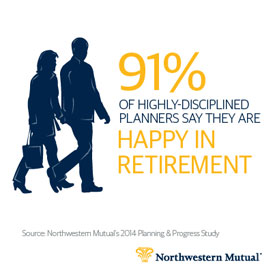

- Highly Disciplined planners who are retired are much more likely than non-planners to say that they are ‘happy in retirement’ (91% vs. 63%)

Overall Discipline Remains Low

Less than one in five U.S. adults (18%) consider themselves Highly Disciplined financial planners – i.e., they know their exact goals, have developed specific plans to meet them and rarely deviate from those plans

- One-third (36%) consider themselves Disciplined – i.e., they know their exact goals and have developed specific plans to meet them, but those plans can deviate at times because they don’t always stay on top of them.

- Nearly half of adults (46%) are either Informal planners or don’t do any planning at all.

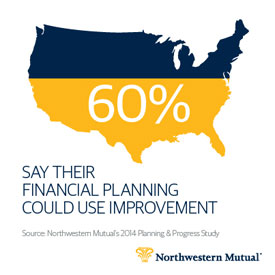

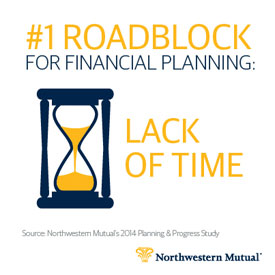

Additionally, 60% of all respondents in the study believe their financial planning could use improvement; and the number one roadblock, cited by more than one in four (27%), is lack of time.

Who Are the Most Disciplined Financial Planners in America?

Younger adults (18-39) and more senior adults (60+) have something very important in common – they represent the most disciplined financial planners in the U.S. Meanwhile, adults who fall between ages 40-59 are the most financially unprepared and most likely to identify themselves as Informal or non-planners.

The study found:

- 59% of younger adults (18-39) and 54% of more senior adults (60+) identify themselves as disciplined financial planners, while less than half of adults aged 40-50 believe they are disciplined.

- More than half (51%) of adults aged 40-59 identify themselves as Informal or non-planners, whereas that number drops to 41% in younger adults (18-39) and 46% in senior adults (60+).

Do Young Boomers Have Their Heads in the Sand?

The study found that 60% of the youngest Baby Boomers (50-59) acknowledge the need to improve their savings and investing discipline, yet they have the least appetite for doing so. Why the disconnect?

The study showed for 25% of Americans aged 50-59, the biggest barrier is simply a lack of interest (25%), while 13% cite lack of money.

Additionally, among these young Boomers:

- 70% don’t use a financial advisor.

- 40% say they take an “informal” approach to financial planning.

- 12% wouldn’t call themselves planners at all – the highest percentage of any age bracket surveyed.

Download the 2014 Planning and Progress Study – Financial Discipline and Happiness in Retirement

Millennials Approach to Money Management

It’s not just beards, butchers and bicycles that Generation Y – or “Millennials” – are bringing back. The youngest adults in America, aged 18-29, are also showing signs that they’re old souls in the way they manage their money.

According to the study, Millennials recognize the importance of saving and investing and tend to be more proactive about planning than their older counterparts.

The study surfaced a range of distinct attitudes and behaviors toward money among Millennials, notably:

- They’re not swinging for the fences – only 14% say that when it comes to saving and investing, they are aiming high and pursuing as much growth as possible.

- They’re willing to be patient – 30% favor “slow and steady” as their financial planning approach, while another 30% would prefer to be more cautious but feel they have a lot of catching up to do.

- They’re the most disciplined generation since their grandparents – in fact, they’re even more disciplined than their grandparents. Even though they’re just starting out, 62% say they are “highly disciplined” or “disciplined” financial planners, as compared to 54% for adults aged 60+.

- They’re humble – despite their focus on planning, 68% believe there is room for improvement in how they manage their money.

Millennials want help but don’t know where to turn for it

Though they may be ahead of the curve in making financial planning a priority, the large majority of Millennials recognize they can do even better.

- As noted above, though more than two-thirds (68%) say there is room for improvement, the Millennial generation is most likely to say they’re uncertain where to find help (28%).

- Only one in eight 18 – 29 year-olds (13%) have a financial advisor.

To support Millennials on their journey toward financial independence, Northwestern Mutual recently launched http://www.themintgrad.org/, a financial education resource with content and tools designed for the unique needs of this generation.

Download Planning and Progress 2014 - Millennials Approach to Money Management

Financial Optimism in the U.S.

Americans feel slightly better about their financial circumstances today than they did a year ago, yet their optimism is tempered by the need to close a gap in their long-term savings and the continuing effects of the slow-growth economy. Forty-two percent of adults age 25 and older expect their financial situation to improve this year, though one in five say they still have a lot of catching up to do.

According to this year’s study, people age 25 and older feel they’re moving – slowly – in the right financial direction:

- Close to half (47%) feel financially secure, a slight uptick from the 43 percent who felt this way last year.

- One in four (26%) express feelings of “financial insecurity” today, which is down from the one in three (32%) who said the same a year ago.

- “Slow and steady” remains the savings and investing strategy most favored by Americans for the third year in a row.

While Americans believe they’re moving in the right direction personally, the study finds that they do not feel the same about the country as a whole. For example:

- Half (49%) of adults 25+ believe the U.S. economy is “stuck in neutral,” and 29% feel it’s “going in reverse.”

- Only 22% say the economy is “moving forward.”

Are Americans Prepared for Longevity?

The study also revealed some interesting findings when it comes to financial preparedness later in life.

- One-quarter of adults 25 and older (26%) do not believe they’ll be financially prepared to live to the relatively young age of 75, based on their current financial condition, future prospects and long term plan.

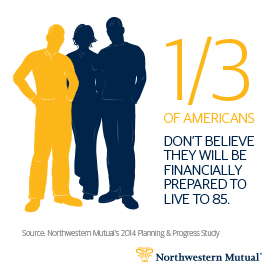

- One-third (32%) don’t believe they’ll be financially prepared to live to 85.

- Nearly 40% don’t believe they’ll be financially prepared to live to 95.

- One in five (21%) say they are playing “catch up” when it comes to savings and investments. Debt, unexpected expenses and a lack of effective planning are cited most often as the reasons for this.

Planning Beyond the Savings Account

Being financially prepared requires more than just relying on one’s savings. It means having the appropriate solutions in place to navigate your changing needs over the arc of your lifetime.

The 2014 Planning & Progress Study revealed that, while two-thirds (67%) of American adults 25+ have a savings account, the majority of people aren’t planning beyond it. For example:

- Only 27% own stocks and only 14% own bonds.

- 23% own mutual funds.

- 14% own real estate.

- 24% own term life insurance, and 23% have permanent life insurance.

- 14% have an annuity.

- 9% have long term care insurance, and 8% have disability insurance.

- 39% have an IRA.

- 6% have a college savings account.

Download the 2014 Planning and Progress Study – Financial Optimism in the United States

Priorities Among Americans

“Personal finances” and “personal health” are the top two priorities for Americans in 2014, ahead of things like “spending time with family and friends” and “career.” But prioritizing appears to stop short of taking action when it comes to personal finance. While six in ten adults (60%) say their financial planning needs improvement, a large majority are not seeking professional help. Two-thirds of Americans don’t have a long-term financial plan, and 71% do not have a financial advisor.

According to the study, the majority (70%) of American adults feel that the economy will experience future crises and that they need a financial plan to help them weather the ups and downs (52%). But only two in five agree their financial plan can withstand market cycles.

Who Uses Financial Advisors

According to the study, roughly three in ten U.S. adults choose to work with a financial advisor. A closer look at them reveals:

- They’re focused – 69 percent of those who use advisors consider themselves disciplined planners and 68% feel very financially secure.

- They have more grey hair – Americans aged 60 and older are three times as likely as those aged 18-29 to use an advisor (41% versus 13%).

- They have larger families – those who are married or living with their partner are twice as likely as those not married to use an advisor (33% versus 17%), and parents are more likely to enlist the services of a professional financial advisor more often than those without children (34% versus 20%).

Staying Engaged

The study found that, among American adults who do have long-term financial plans, too many are not taking the time to revisit them to help ensure they evolve with changing needs and goals over time. For example, the study found that one in four (25%) Americans with written financial plans review them quarterly, and 30% review them annually.

Download the 2014 Planning and Progress Study - Priorities Among Americans

Retirement Redefined

Significant differences exist between the attitudes and expectations of Americans who are currently working vs. those already retired, according to the most recent findings from Northwestern Mutual’s 2014 Planning and Progress Study.

Most notably, the research suggests that substantial changes in retirement age and lifestyle are on the horizon, and people expect to work longer, but a sizable number will do so by choice rather than necessity. Others – and there are plenty of them – aren’t as fortunate and don’t feel they’ll have the luxury of choice.

Among retirees:

- The average age they retired was 59.

- The large majority (72%) say they are completely retired from working.

Among those still working:

- The average age they expect to work until is 68 (nearly a decade longer than the retirees in the study).

- Nearly half (45%) say they will continue to work in retirement, not because they have to but because they want to.

Sizable numbers of others who are still working are either uncertain about when they’ll retire or know they don’t have many choices:

- One in five (21%) is not sure how many years he or she will spend in retirement.

- More than one in ten (13%) think they’ll never be able to retire.

- Nearly four in ten (38%) aged 60 and over estimate that they will have to work until age 75 or older before they can retire.

Working Adults Are Pessimistic, but Retirees Say Life After Work Is Pretty Darned Good

Working adults tend to use words like ‘bad/poor,’ ‘bleak/dismal’ and ‘nonexistent’ to describe their vision of their own future retirement, whereas retired Americans are more apt to choose words like ‘fun/cheerful’ and ‘good/pleasant’ to describe their retired life today and tomorrow.

The gap between expectations and experience is evident in other research findings as well. For example:

- Only 37% of working adults expect they will be happier in retirement than they are now.

- But 84% of current retirees say they are happy in retirement, and 60% say they’re happier now than they were when they were working.

- 70% of retirees describe their lives as ‘fulfilling,’ and a large majority focus on health and fitness and stay active with charities.

Still, while the majority of retirees say they lead fulfilling lives, it’s not as if they haven’t had to deal with curveballs. Half of retirees saw health care costs increase significantly in retirement, and among them 45% didn’t anticipate these expenses.

This underscores the need for planning. In findings released earlier by Northwestern Mutual, the study revealed a link between the discipline an individual brings to financial planning and his or her happiness in retirement. Retirees who identify themselves as “Highly Disciplined” planners are much more likely than non-planners to say that they are “happy in retirement” (91% vs. 63%).

Americans are encouraged to take the first step in getting a handle on retirement by talking to someone about their concerns. The study found that 42% of adults have never had a conversation with anyone about retirement.

Download the 2014 Planning and Progress Study – Retirement Redefined

Money and Retirement

When it comes to conversation, Americans would rather talk about their own death and the birds and the bees instead of talking with friends and family about money, and more than two in five Americans have not spoken to anyone about their retirement.

American adults aged 18+ were asked about the difficulty they might have in talking to others on a range of sensitive subjects; the order of difficulty (somewhat/very difficult) is as follows:

- Asking to borrow money from your parents (48%)

- Asking for money back that you loaned a friend/family member (42%)

- Asking for a raise/promotion (37%)

- Long-term care needs of your parents (35%)

- Asking your parents about their wills/estates (31%)

- Your death / preparations and preferences with your family (30%)

- Asking your boomerang kids to move out (25%)

- Budgets and the need to stick to them with your spouse / partner (23%)

- The birds and the bees (21%)

- Asking your adult-age children to get a job (15%)

The study found that the topic of retirement is noticeably absent from people’s regular discourse. In fact, the Planning and Progress Study found that 42% of American adults have not spoken to anyone about their retirement, and only 39% have had conversations with their spouse or partner about the subject.

Download the 2014 Planning and Progress Study – Talking Money and Retirement