2019 C.A.R.E. Study

For most families, caring for mom or dad as they age is not a family effort. According to new data from Northwestern Mutual’s latest C.A.R.E. Study, the responsibility most likely falls on the shoulders of one sibling, rather than being shared among all the children.

Findings reveal that two in five caregivers are caring for or have cared for a parent and, while the majority (83%) have siblings, only one in 10 say siblings equally share responsibilities as a team. Rather, 40% say their siblings don’t assist in caring for their parent at all, and an additional 41% indicate that while siblings offer some help, they themselves are the primary caregiver.

Is there a choice when it comes to stepping up as a caregiver?

While more than half of caregivers (58%) knew in advance that they would be providing care, for two in five, it was not discussed and was completely unexpected. This factor – whether a caregiver knows in advance about taking on this role – impacts how they feel about the choices they have:

- 58% of caregivers who feel they did not have a choice in becoming a caregiver said there was no discussion ahead of time and it was totally unexpected.

The perception of choice is also influenced by age and relationship with the person receiving the care:

- 72% of Millennials report that they had a choice, followed by Gen X (56%). Whereas 62% of Baby Boomers don’t feel they had a choice.

- Two in three (65%) of those caring for a spouse don’t feel they have/had a choice, versus 51% of those caring for a parent.

Financial, emotional and practical realities

The study looks at the financial and practical realities of caregiving and finds:

- Caregivers define caregiving as a combination of practical/personal care support (42%), emotional support (34%) and financial support (23%).

- 55% of caregivers are providing more than six hours a day of care over an expected average of almost 10 years of total care.

- When it comes to getting support for their caregiving responsibilities, most turn to friends (43%) before siblings (34%) for help with the emotional aspects of support, but rely equally on siblings, other family members and healthcare professionals for practical/personal care support (28%).

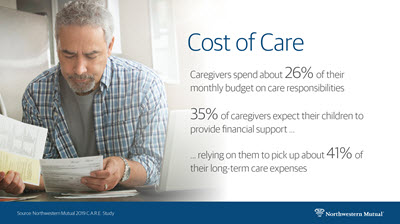

- Caregivers are spending on average 26% of their own monthly budget on caregiving, a percentage that is slightly higher for Millennials (32%) versus Gen X (25%). They mostly don’t seek any support when it comes to financial needs (43%). If they do, they will ask family members (22%) or siblings (20%), rather than friends (13%).

A whole new meaning to the phrase “parents’ expectations”

Despite their own experience, 72% of caregivers have not planned for their own long-term care needs. Moreover, two in three haven’t spoken about preferences for their care either because they just expect it will be taken care of as it has always been done in their family (37%), or because they don’t have any expectation that anyone would be responsible for them (30%).

Among those who have planned:

- 47% increased their savings

- 39% purchased long-term care insurance

- 37% incorporated long-term care into their financial plan

- 31% talked to their financial advisor

The majority (76%) of caregivers anticipate their family will provide their care, either their spouse/partner (41%), another family member (31%) or their children (29%).

Caregivers who have or expect to have children themselves assume their children will provide long-term care in terms of:

- Emotional support - 71%

- Practical/personal care support - 52%

- Financial support - 35%, which is even higher for Millennials, among whom 47% expect their children will provide financial support

Overall, caregivers who will look to their children for financial support anticipate they will rely on them for an average of 41% of their financial support needs.

“There’s a real disconnect between perceptions and realities when it comes to caregiving,” notes Simbro. “With a little foresight and candid conversations, families can avoid the unnecessary stress of decision-making on the fly and can take steps, including working with a trusted professional, to feel confident in the plans they put in place.”

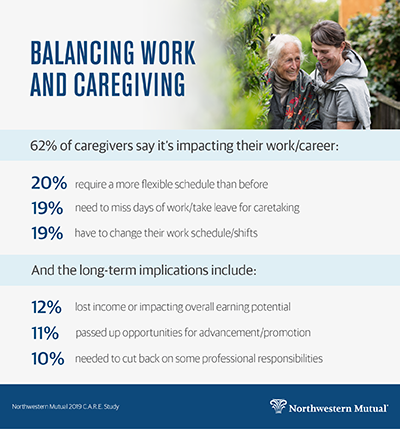

A new release of findings from Northwestern Mutual’s C.A.R.E. (Costs, Accountabilities, Realities, Expectations) Study reveals the degree to which caring for a friend or loved one can shift work responsibilities and overall career paths. Two-thirds of caregivers (66%) are working while also providing care, and likewise, nearly two in three (62%) caregivers say their caregiving responsibilities are impacting their work and professional lives.

A closer look at the generational breakdown shows a more pronounced impact on younger generations that are still in their prime working years: nearly three-quarters of Millennials (73%) and Gen Xers (75%) report balancing caregiving and employment, the highest across the generations. Both note that caregiving has an impact on their careers, at 70% and 69% respectively.

According to the data, some of the long-term impacts on individuals’ careers include:

- Lost income or impact my long-term earning potential

- Passed up opportunities for advancement/promotion

- Need to cut back on some of my professional responsibilities

Men are more likely than women to be balancing work and caregiving. Men report having some sort of employment (either full or part time or self-employed) at higher rates than women in the study (76% vs. 59%, respectively). Additionally, the impact on their career is more pronounced: over two-thirds (67%) of men say it’s impacted their careers, while a little over half of women say it has (58%).

A Balancing Act That for Some is Hidden

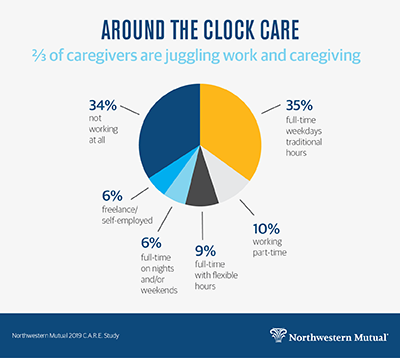

Half (50%) of caregivers are working full time with most still working traditional 9-to-5 hours. Others are working during non-traditional hours or with flexible hours to better accommodate for their caregiving responsibilities, or not at all (34%). This includes:

- Full time weekdays traditional hours – 35%

- Working part-time – 10%

- Full time with flexible hours – 9%

- Full time on nights and/or weekends – 6%

- Or are freelance/self-employed – 6%

For these working caregivers, almost a quarter (24%) say their colleagues do not know they are also providing care. Millennials are the most likely not to tell their co-workers, with nearly three out of 10 (28%) saying their colleagues are unaware of their additional responsibilities outside of the office. Men are significantly less likely than women to tell their coworkers they are also caregivers, with 71% saying their coworkers know compared to 81% of women who report the same.

The biggest impact for working caregivers (20%) is that they require a more flexible schedule than before. Other areas of their work/career they reported being affected include:

- Have needed to miss days of work/take leave to attend to caretaking responsibilities – 19%

- Had to change my schedule/shifts – 19%

- Needed to use vacation time to address caretaking responsibilities – 16%

- Had to reduce work hours – 14%

Caregivers: Doing it All

Caregivers are not looking for assistance in other areas of running their daily lives. As they consider other ways to increase their own personal caregiving capacity, only 13% have added childcare support for their own children, 23% outsource their own home cleaning, 21% outsource their own meal preparation, and 23% outsource their own errands like groceries, dry cleaning, etc.

Half (49%) of caregivers are turning to technology to help them manage their caregiving responsibilities. Some of these technologies include medication management devices (20%), home monitoring technology (20%), wearable safety devices (18%), voice assistants (15%), video conferencing (13%), and care coordination apps (13%).

To learn more, visit Northwestern Mutual's lifespan calculator or long-term care planning tips.

This is the latest round of findings from the 2019 C.A.R.E. Study, an annual research survey which explores longevity risk and caregiving. The first wave of data released earlier this year explored caregiving’s impact on family dynamics and the financial and practical realities of care.