Planning & Progress Study 2024

The 2024 Planning & Progress Study, an annual research study from Northwestern Mutual, explores U.S. adults’ attitudes and behaviors toward money, financial decision-making, and the broader issues impacting people’s long-term financial security.

Americans have a rosier view of the direction of the U.S. economy, and yet, their feelings of financial insecurity have hit a record high.

Just over half (54%) of U.S. adults expect the United States will enter a recession this year. While still a majority, it’s a substantial drop from the two-thirds (67%) who predicted a recession last year. These more positive economic expectations are consistent across generations, with double-digit increases in optimism among Gen Z, Millennials, Gen X and Boomers+ alike.

|

Expectations that the economy will enter into a recession this year |

||||

|

|

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

2024 |

62% |

59% |

53% |

48% |

|

2023 |

74% |

72% |

70% |

60% |

|

Difference |

12% |

13% |

17% |

12% |

At the same time, Americans’ feelings of personal financial insecurity are on the rise. One-third (33%) of adults say they do not feel financially secure. This represents a jump from 27% who said the same last year and is the highest level of insecurity recorded in the study’s history. The Northwestern Mutual Planning & Progress Study started in 2009, and began measuring financial security using its current methodology in 2012.

Inflation is the clear driver underpinning that insecurity. Despite dropping substantially from its peak in 2022, inflation rates continue to weigh heavy on Americans’ minds. More than half (54%) of U.S. adults expect inflation to increase this year, and only 9% say their household income is outpacing it. By far, inflation is considered the greatest obstacle to financial security, coming in well ahead of factors such as lack of savings and debt.

|

Expectations for inflation in 2024 |

U.S. Adults |

|

Household income vs. inflation |

U.S. Adults |

|

Greatest obstacles to financial security |

U.S. Adults |

|

Increase |

54% |

|

Growing slower |

52% |

|

Inflation |

51% |

|

Decrease |

18% |

|

On pace |

30% |

|

The economy |

43% |

|

Stay the same |

28% |

|

Growing faster |

9% |

|

Lack of savings |

31% |

|

|

|

|

Not sure |

9% |

|

Personal debt |

27% |

|

|

|

|

|

|

|

Healthcare costs |

22% |

Government Dysfunction and the Presidential Election are Among People’s Top Concerns for 2024

Beyond inflation, Americans are particularly worried about the impact that decisions – or indecision – by government officials could have on their financial well-being this year. When asked to rank the concerns that could impact their finances the most in 2024, “inflation” (57%) topped the list but “government dysfunction” (34%) and “the U.S. Presidential Election” (33%) ranked second and third, coming in ahead of longer-term worries such as “a potential recession” (24%), “interest rates” (24%), “market volatility” (15%) and “geopolitical conflicts” (14%).

Playing Defense

Given current market and economic conditions, 42% of U.S. adults feel 2024 is a year to prioritize “playing defense” with their savings and investments (managing risk to protect their assets) vs. 29% who feel it’s a year to be “playing offense” (capitalizing on opportunities to grow their assets); and 29% are unsure.

The gameplan for those who favor playing defense is mostly focused on cutting costs (56%) and building savings (51%). Younger generations score higher on adding a side hustle (46% for Gen Z and 43% for Millennials). About one in six Millennials (16%) said that they would get a financial advisor, while 15% said they would buy life insurance or increase life insurance coverage. Among high-net-worth individuals – people with more than $1 million in investable assets – higher numbers reported moving into safe, high-yielding instruments like money market funds (40%).

The gameplan for those who favor playing offense is mostly focused on investing more in the stock market (42%), particularly for Gen Z (52%) and the high-net worth (50%). About half as many Americans indicated interest in investing more in real estate (21%), high-yield bonds (21%), alternative assets like hedge funds and private equity (19%), and speculative investments like cryptocurrencies (17%). Just 9% expect to invest more in gold or silver.

Discipline in Decline

Intentions don’t always translate to action when it comes to financial planning. In fact, the research shows a continued decline among Americans who consider themselves “disciplined” financial planners – from 65% in the post-Covid 2020 study to 45% in 2024.

|

U.S Adults who consider themselves “disciplined” financial planners |

|

|

2020 |

65% |

|

2021 |

60% |

|

2022 |

59% |

|

2023 |

50% |

|

2024 |

45% |

People are Still Spending

Despite high levels of financial insecurity, many Americans don’t expect to largely pull back their spending on discretionary things like restaurants, vacations and entertainment in 2024. The research finds 59% of U.S. adults say they’ll either spend the same or more on these purchases year-over-year, while just under four in 10 (37%) say they’ll spend less. Among generations, Gen Z is the most likely to say they’ll increase non-essential spending and Gen X is the most likely to say they’ll be tightening their belts.

|

Discretionary spending in 2024 vs. 2023 |

U.S. Adults |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

More |

26% |

36% |

28% |

24% |

20% |

|

The same |

33% |

25% |

30% |

31% |

42% |

|

Less |

37% |

35% |

38% |

41% |

35% |

|

Unsure |

4% |

5% |

4% |

4% |

4% |

In forthcoming data sets, Northwestern Mutual’s 2024 Planning & Progress Study will explore wide-ranging issues facing Americans spanning savings and debt, work and retirement, planning, priorities and more.

Read the news release

Read the 2024 Planning and Progress Study - The Financial States of America

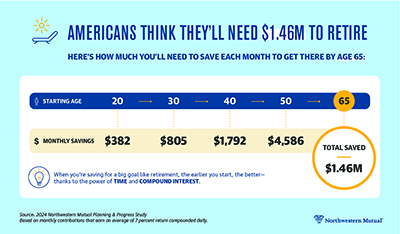

Americans’ “magic number” for retirement is surging to an all-time high – rising much faster than the rate of inflation while swelling more than 50% since the onset of the pandemic.

U.S. adults believe they will need $1.46 million to retire comfortably, a 15% increase over the $1.27 million reported last year, far outpacing today’s inflation rate which currently hovers between 2% and 3%. Over a five-year span, people’s ‘magic number’ has jumped a whopping 53% from the $951,000 target Americans reported in 2020.

|

|

2024 |

2023 |

2022 |

2021 |

2020 |

|

Amount expected to need to retire comfortably |

$1.46M |

$1.27M |

$1.25M |

$1.05M |

$951K |

By generation, both Gen Z and Millennials expect to need more than $1.6 million to retire comfortably. High-net-worth individuals – people with more than $1 million in investable assets – say they’ll need nearly $4 million.

|

2024 |

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

HNW ($1M+) |

|

Amount expected to need to retire comfortably |

$1.46M |

$1.63M |

$1.65M |

$1.56M |

$990K |

$3.93M |

Meanwhile, the average amount that U.S. adults have saved for retirement dropped modestly from $89,300 in 2023 to $88,400 today, but is more than $10,000 off its five-year peak of $98,800 in 2021.

|

|

2024 |

2023 |

2022 |

2021 |

2020 |

|

Amount saved for retirement currently |

$88,400 |

$89,300 |

$86,900 |

$98,800 |

$87,500 |

|

Gap between retirement goal and current savings |

$1.37M |

$1.18M |

$1.16M |

$951K |

$864K |

Across all segments, there are large gaps between what people think they’ll need to retire and what they’ve saved to date.

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

HNW ($1M+) |

|

Amount saved for retirement currently |

$88,400 |

$22,800 |

$62,600 |

$108,600 |

$120,300 |

$172,100 |

|

Gap between retirement goal and current savings |

$1.37M |

$1.61M |

$1.59M |

$1.45M |

$870K |

$3.76M |

Gen Z: Starting sooner with the aim of ending earlier

The average age that Americans say they started saving for retirement is 31. But for Gen Z, it’s 22 – nearly a decade earlier. It’s also a full 15 years before Boomers+ who say they started when they were 37. Millennials and Gen X’ers began saving for retirement at ages 27 and 31, respectively.

The hope among Gen Z is that by starting to save sooner, they’ll be able to retire earlier. They expect to retire at the age of 60, a dozen years before Boomers+ who say they’ll work until they’re 72. Millennials and Gen X’ers expect to work until 64 and 67, respectively. The average age most people expect to work to is 65.

The research discovered that three in 10 Millennials and Gen Z Americans believe it’s likely or highly likely that they will live to age 100. The sentiment among these younger generations is stronger than older generations. Among Gen X and Boomers+, just 22% and 21% respectively agreed that they believed they would live to 100.

The ‘Silver Tsunami’ is here

In 2024, more than four million Americans will turn 65. That’s an average of 11,000 Americans per day, and it will continue through 2027. It’s the largest surge of Americans hitting the traditional retirement age in history.

The 2024 Planning & Progress Study found that among generations closest to retirement, just half of Boomers+ (49%) and Gen X (48%) believe they will be financially prepared when the time comes.

On average, Gen X believes there is a 42% chance they could outlive their savings, while Boomers+ put the probability at 37%. Across both generations, more than a third (37% and 38%, respectively) have not taken any steps to address the possibility of outliving their savings.

When digging into some of the most pressing challenges associated with retirement planning, the research shows that Boomers+ and Gen X don’t have markedly strong confidence in their preparedness.

|

|

Boomers+ |

Gen X |

|

I know how much money I will need to retire comfortably |

49% |

40% |

|

I have a plan to address healthcare costs in retirement |

56% |

44% |

|

I have planned for the possibility that I could outlive my savings |

37% |

35% |

|

I have a plan to address long-term care needs in retirement |

41% |

34% |

|

I have planned for the potential that Social Security may or may not be in place when I qualify for it |

39% |

42% |

|

I will have enough to leave behind an inheritance or gift to loved ones and/or charitable causes I care about |

50% |

36% |

|

I have a good understanding of how taxes could impact my retirement and have factored that into my financial plans |

58% |

46% |

|

I have a good understanding of how potential drops in the stock market could impact my retirement and have factored that into my financial plans |

58% |

51% |

Taxes are an afterthought

Only three in 10 (30%) Americans have a plan to minimize the taxes they pay on their retirement savings. Among them, the top 10 strategies employed include:

- Making withdrawals strategically from traditional and Roth accounts to remain in a lower tax bracket (32%)

- Using a mix of traditional and Roth retirement accounts (30%)

- Making strategic charitable donations (24%)

- Using a Health Savings Account (HSA) or other tax-advantaged healthcare account (23%)

- Using products like permanent life insurance or annuities for the tax benefits (22%)

- Making Roth conversions prior to taking RMDs or Social Security (19%)

- Using qualified charitable distributions from an IRA (17%)

- Making contributions to other tax-advantaged accounts like a 529 (14%)

- Using the basis paid into the cash value of permanent life insurance to remain in a lower tax bracket (13%)

- Taking advantage of a Qualified Longevity Annuity Contract (QLAC) to set aside funds for later in retirement (13%)

In forthcoming data sets, the 2024 Planning & Progress Study will explore wide-ranging issues facing Americans spanning savings and debt, retirement income, emerging technology, professional help and more.

Read the 2024 Planning & Progress Study – Work, Retirement & Taxes

Among American parents saving for their children’s college education, 95% expect to cover more than half of the cost for their children. While about one in three (36%) say they will pay for the full cost, two in three (64%) expect their child to pay something. These are among the latest findings from Northwestern Mutual’s 2024 Planning & Progress Study.

About a third of parents saving for their kids’ educational expenses (37%) anticipate that child’s contribution to be between 1-25%. Meanwhile, a fifth (22%) anticipate it to be between 25-50%.

|

Parents saving for college for their children say they expect their kids to contribute the following: |

|

|

Nothing (parents will have full responsibility) |

36% |

|

Up to a quarter |

37% |

|

Between a quarter and half |

22% |

|

More than half |

5% |

According to the Northwestern Mutual research, two in ten adults in America (led by 40% of Gen Z) are saving for college, either for themselves or a family member. On average, they expect the total cost of college to be $77,300 and aim to pay it off by the age of 45. Each American’s actual college expenses may vary significantly, based on the type of school, the level of the institution, and the student’s living arrangements.

Among those who are saving for college for either themselves or an immediate family member, 23% are still paying off their own student debt.

Americans’ debt levels are growing.

In 2024, Americans’ personal debt, exclusive of mortgages, ticked up slightly between 2023 and 2024. The study revealed that two-thirds (66%) of Americans currently hold at least some personal debt, and the average amount people owe is $22,713.

|

Americans' Personal Debt, Exclusive of Mortgages |

|

|

2024 |

$22,713 |

|

2023 |

$21,800 |

|

2022 |

$22,354 |

|

2021 |

$23,325 |

|

2020 |

$26,621 |

|

2019 |

$29,803 |

The primary source of debt is credit cards, which account for more than double the #2 source (car loans) and more than triple the #3 source (education).

|

What is Your Main Source of Debt? Please Select One. |

|

||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Credit card bills |

28% |

21% |

30% |

30% |

29% |

|

Car loan |

13% |

10% |

13% |

15% |

13% |

|

Personal education loans |

8% |

17% |

11% |

6% |

2% |

|

Medical debt |

7% |

8% |

9% |

9% |

5% |

|

Educational expenses for children/family |

5% |

7% |

6% |

5% |

2% |

|

Caring for loved ones |

3% |

6% |

4% |

2% |

1% |

|

I have no debt |

34% |

31% |

25% |

31% |

46% |

Gen X and Millennials carry the most total personal debt.

In both age groups, more than four in ten – 42% of Gen X’ers and 43% of Millennials – say their personal debt is at or near its highest level ever.

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Average debt, exclusive of mortgages |

$22,713 |

$16,478 |

$24,833 |

$28,670 |

$18,272 |

Meanwhile, only six in ten Millennials (59%) and Gen X’ers (57%) say that they have a specific plan in place to pay down their debts.

For people who carry personal debt, an average of 29% of their monthly income goes toward paying it off. That’s a sizable chunk off the bottom line and may explain why people are increasingly prioritizing paying down debt before building savings. Lenders generally prefer that a person’s debt-to-income ratio (DTI) is below 43 percent – although some want it to be no higher than 31 percent.

The urgency to pay down debt is growing. But action to get it under control is lacking.

The Northwestern Mutual study found that 64% of adults say they prioritize paying down debt versus 36% who put saving first. That continues a two-year trend which has seen a growing urgency to focus on debt first. At the same time, the number of people who report having specific plans to pay off their debt has dropped over the same period, from 64% in 2022 to 59% today.

|

Which Do You Prioritize? |

|||

|

|

2022 |

2023 |

2024 |

|

Saving Money |

43% |

39% |

36% |

|

Paying Down Debt |

57% |

61% |

64% |

|

Do You Have a Specific Plan In Place to Pay Off Debt? |

|||

|

|

2022 |

2023 |

2024 |

|

Yes |

64% |

61% |

59% |

|

No |

36% |

39% |

41% |

Interestingly, the study found that saving is more of a priority for younger adults whereas paying down debt becomes more of a priority as people age.

|

Which Do You Prioritize More? |

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Saving money |

36% |

48% |

42% |

35% |

25% |

|

Paying down debt |

64% |

52% |

58% |

65% |

75% |

The survey also showed that striking a balance between spending and saving is getting murkier for many Americans. The number of U.S. adults who lack clarity on how much they can afford to spend now vs. how much to save for later has risen from a quarter (26%) in 2021 to a third (34%) today – reiterating the importance of a comprehensive financial plan.

|

Do You Have Clarity on Exactly How Much You Can Afford to Spend Now Vs. How Much You Should Be Saving for Later? |

||||

|

|

2021 |

2022 |

2023 |

2024 |

|

Yes |

74% |

71% |

70% |

66% |

|

No |

26% |

29% |

30% |

34% |

Emergency funds can provide a safety net – for some.

Six in ten (60%) Americans say they have an emergency fund – cash or other liquid assets independent of money earmarked for specific goals such as retirement funds in a 401k or IRA. That means four in ten Americans (40%) do not have any emergency savings.

Among those who do have emergency funds, the average amount they have saved is $25,500. Only half (53%) say their savings would be enough to cover more than six months of expenses.

In forthcoming data sets, the 2024 Planning & Progress Study will explore wide-ranging issues facing Americans spanning retirement income, emerging technology, professional help, generational planning and more.

Younger Americans are More Optimistic than Older Americans About the Potential of AI to Help Manage Money, According to Northwestern Mutual’s 2024 Planning & Progress Study

As artificial intelligence (AI) continues to evolve and fuel debate about its transformative power on business and society, younger Americans are far more optimistic about the technology’s potential to help them reach their financial goals. More than half of Gen Z’ers (57%) and Millennials (55%) say they are excited about the impact AI and generative AI (GenAI) tools could have on their financial lives. Meanwhile, older Americans are more skeptical – only 38% of Gen X’ers and 23% of Boomers+ say they are excited. These are the latest findings from Northwestern Mutual’s 2024 Planning & Progress Study and the first-ever research findings on AI in the study’s history.

According to the survey results, 63% of Gen Z and 57% of Millennials say AI will “improve the customer experience in the financial sector, including with financial planning.” Conversely, less than half of Gen X (44%) and Boomers+ (32%) share this sentiment.

|

AI will improve the customer experience in the financial services sector, including with financial planning. |

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Yes |

47% |

63% |

57% |

44% |

32% |

|

No |

53% |

37% |

43% |

56% |

68% |

|

I’m excited about the potential of AI/GenAI in the financial services industry. |

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Yes |

41% |

57% |

55% |

38% |

23% |

|

No |

59% |

43% |

45% |

62% |

77% |

When asked to identify the potential benefit of AI Americans’ are most excited about when it comes to managing their money, “advanced data analysis” emerged as the top choice. Faster response times, increased efficiencies, improved customer service and greater opportunities for customization rounded out the remainder of the top five benefits.

“Younger generations are more willing to accept having their financial services partners leverage GenAI to manage their money,” said Christian Mitchell, executive vice president and chief customer officer at Northwestern Mutual. “However, even older generations say they are comfortable with their financial advisor leveraging the technology to ask even better questions and help them build wealth and financial security. The majority believe AI and GenAI can be a fantastic addition for a trusted advisor, helping financial professionals deliver even better results and experiences for their clients. The bottom line is this: artificial intelligence can help organizations find human capacity, not replace it.”

The future is human + digital

In a pure side-by-side comparison, the research shows that people trust humans (54%) far more than AI alone (15%) across most core elements of financial planning, from creating a retirement plan to asking a financial question to managing budgets.

|

Who do you trust more in the following scenarios? |

Not sure |

Both the same |

Artificial Intelligence (AI) more |

Humans more |

|

Creating a retirement plan |

10% |

19% |

12% |

59% |

|

Asking a financial question |

8% |

20% |

13% |

59% |

|

Developing a tailored, robust financial plan |

11% |

18% |

15% |

56% |

|

Creating a savings plan |

9% |

21% |

14% |

55% |

|

Making asset allocation decisions, building and managing investment portfolios |

13% |

20% |

14% |

53% |

|

Recommending financial products |

11% |

21% |

15% |

53% |

|

Providing financial savings tips |

10% |

23% |

15% |

52% |

|

Making updates to your personal customer information |

10% |

21% |

16% |

52% |

|

Managing a budget and keeping me on track |

10% |

23% |

18% |

49% |

|

AVERAGE: |

10% |

21% |

15% |

54% |

At the same time, the survey shows that people are largely comfortable with financial advisors and providers using AI tools for common tasks like fraud detection, answering service calls and joining meetings, and capturing notes, to more sophisticated tasks like predicting financial trends and modeling financial planning scenarios.

|

What is your comfort level with financial advisors using AI to… |

Very uncomfortable |

Somewhat uncomfortable |

Somewhat comfortable |

Very comfortable |

Total Comfortable |

|

Detect fraud |

15% |

16% |

38% |

31% |

69% |

|

Analyze data to predict future trends that could inform decision-making |

16% |

20% |

41% |

23% |

64% |

|

Model and illustrate multiple financial scenarios to better visualize possible outcomes |

16% |

20% |

43% |

21% |

64% |

|

Analyze data related to your financial habits, preferences, decisions and behaviors to identify areas for adjustments / improvements |

17% |

22% |

41% |

21% |

62% |

|

Provide real-time financial guidance |

18% |

25% |

39% |

18% |

57% |

|

Join meetings with you and be responsible for capturing information and prompting next steps |

20% |

28% |

37% |

16% |

53% |

|

What is your comfort level with financial service firms using AI to… |

Very uncomfortable |

Somewhat uncomfortable |

Somewhat comfortable |

Very comfortable |

Total Comfortable |

|

Answer a straightforward financial question |

18% |

20% |

39% |

22% |

61% |

|

Make updates to your basic customer data |

19% |

23% |

37% |

21% |

58% |

|

Answer service calls and respond to your questions |

21% |

26% |

36% |

18% |

54% |

|

Make updates to your existing financial plan |

22% |

28% |

34% |

17% |

51% |

“It’s still very early in terms of how far the technology will go, but AI tools are going to allow for the mass automation of tasks, significantly reducing manual work and deeply improving efficiencies across not just financial services, but most industries,” said Mitchell. “By alleviating the most tedious and administrative aspects of our work, it will free up precious time to focus on building human connections and deliverables that provide the greatest value. So, it is people who sit at the heart of this digital transformation. The expertise and personalization that financial advisors provide can’t be replicated or replaced by AI, but it can be enhanced. That’s why we believe the future is human + digital.”

People aren’t ready to replace humans with AI yet… but signs of cautious trust are there.

The study also explored people’s comfort level with AI in a few areas outside of financial planning. While very few are ready to replace humans with AI right away, trust levels in the emerging technology were higher than one might expect. For example, 40% of Americans are either somewhat or very trusting of AI taking over for human umpires and referees in professional sports; 35% say the same about AI taking over for nurses when collecting information such as medical histories and current symptoms during doctor’s visits; a third (33%) say the same about AI taking over from artists to produce movies, books, music and paintings; and nearly a third (32%) say the same about AI taking over for educators to teach core curriculum classes.

|

What is your trust level in leveraging AI / GenAI to take over for… |

Very untrusting |

Somewhat untrusting |

Somewhat trusting |

Very trusting |

Total Trusting |

|

Human umpires and referees in professional sports |

31% |

28% |

28% |

12% |

40% |

|

Nurses when obtaining your medical history / existing symptoms for your doctor visit |

37% |

29% |

25% |

10% |

35% |

|

Artists to produce movies, books, music, paintings, etc. |

39% |

28% |

23% |

10% |

33% |

|

Teachers and professors for core curriculum classes |

40% |

28% |

23% |

9% |

32% |

|

Humans driving cars (i.e., self-driving vehicles) |

42% |

26% |

22% |

10% |

32% |

|

Parents keepings kids accountable and teaching them about responsibility |

45% |

26% |

19% |

9% |

28% |

In forthcoming data sets, the 2024 Northwestern Mutual Planning & Progress Study will explore wide-ranging issues facing Americans spanning retirement income, professional help, generational planning and more.

Read the 2024 Planning & Progress Study – Artificial Intelligence (AI) & Money

Americans who work with a financial advisor expect to retire two years earlier and feel significantly more confident about their financial preparedness for the future. The impact of financial advice from an expert advisor is evident even among wealthy Americans – and it’s especially apparent among Black and African Americans.

Americans with an advisor expect to retire at age 64, two years sooner than Americans who don’t work with an advisor (66). They also have saved twice as much money for retirement than those who do not have an advisor: $132,000 vs. just $62,000. Beyond the balance sheet, Americans with a financial advisor also feel more certain about their ability to reach their financial goals, and more bullish – believing that they reach their goals faster.

Three in four Americans with an advisor (75%) believe that they will be financially prepared to retire, compared to just 45% without an advisor who feel the same. Nearly two in three Americans with an advisor (62%) say they know how much they need to save in order to retire comfortably, while about one in three without an advisor (34%) agree. Moreover, Americans with an advisor predict that they will pay off their student loan debt three years sooner: at age 43 instead of age 46.

The emotional lift that expert advice can create is also visible among Americans’ financial planning attitudes and beliefs.

|

Behaviors and beliefs among all Americans |

||

|

|

With an advisor |

Without an advisor |

|

Have a long-term plan that factors for up-and-down economic cycles over time |

79% |

38% |

|

Have an emergency fund |

84% |

48% |

|

Feel financially secure |

64% |

29% |

|

Have good clarity on how much they can afford now vs. save for later |

79% |

60% |

|

Have taken a step to address possibility of outliving life savings |

83% |

53% |

|

Have a specific plan to pay off debt |

79% |

49% |

|

Have inflation factored into financial plan |

69% |

48% |

|

Have plan to address health care costs in retirement |

69% |

38% |

|

Will have enough to leave behind an inheritance or charitable gift |

64% |

33% |

American millionaires with an advisor feel more financially secure

Among Americans with at least $1 million in investable assets, there’s a big difference in behaviors and beliefs between people with an advisor and others who haven’t sought out expert advice. These high-net-worth Americans with an advisor expect to retire a year sooner (61 vs. 62), and are more likely to believe they will be financially prepared for retirement than millionaires who lack an advisor (92% vs. 77%, a 15 percentage point difference).

The study also found several other notable differences:

|

Behaviors and beliefs among American millionaires |

||

|

|

With an advisor |

Without an advisor |

|

I have a will |

81% |

50% |

|

I have a specific plan in place to pay off debt, exclusive of mortgages |

89% |

67% |

|

I have a long-term financial plan that factors for up and down economic cycles |

89% |

75% |

Average age to seek financial advice is age 38, but for Millennials, it’s 29

Among people who have a financial advisor, the average age this relationship began is 38. Interestingly, younger generations are engaging experts for financial advice earlier and earlier.

The average Millennial with an advisor says they sought formal financial guidance at age 29 – nine years sooner than Gen X (age 38) – and a full 20 years before Boomers+ (age 49). Interestingly, 29 is also the average age when Americans get married, while the median age when a mother has her first child is age 30.

Advisors are Americans’ most trusted source for financial advice

Once again, people across the U.S. say they trust financial advisors more than any other source for financial advice. More than twice as many Americans chose financial advisors (33%) over family members (16%), who ranked second. Interestingly, financial advisors were selected eight times more than online financial influencers and social media sites like Reddit and TikTok (4%).

Gen Z was the only generation to perceive family members as the most trusted source of financial advice, followed closely by financial advisors.

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Financial advisor |

33% |

27% |

28% |

34% |

39% |

|

Family member |

16% |

29% |

17% |

14% |

9% |

|

Spouse/partner |

12% |

9% |

16% |

12% |

10% |

|

Business news |

5% |

5% |

5% |

6% |

6% |

|

Friend |

4% |

5% |

6% |

3% |

3% |

|

Online financial influencers and social media sites (e.g., Reddit, TikTok) |

4% |

6% |

6% |

3% |

0% |

|

Trade associations (e.g. AARP) |

2% |

2% |

3% |

2% |

1% |

|

Local news |

2% |

2% |

2% |

2% |

1% |

|

I have not received financial advice from anyone |

22% |

14% |

17% |

23% |

29% |

Nearly three in ten are seeking an advisor now

Northwestern Mutual’s study found that seven in 10 Americans believe their financial planning needs improvement – and many are taking action. Nearly three in ten Americans (29%) who did not have an advisor before say they plan to start working with one – or have just recently started working with one.

Black individuals with an advisor see significant gains in financial and emotional outcomes

While the research shows financial advice can be impactful for all Americans, among Black and African American individuals, the influence is even more pronounced. Northwestern Mutual’s study found that Black individuals with an advisor expect to retire three years sooner (age 61 vs. 64). They also have almost three times more in retirement savings on average than Black consumers who do not have a financial advisor ($71,000 vs. $26,000). They also expect to pay off their college debt five years earlier (by age 41 vs. 46).

The study also found several other notable differences:

|

Behaviors and beliefs among Black / African Americans |

||

|

|

With an advisor |

Without an advisor |

|

Have a long-term plan that factors for up-and-down economic cycles over time |

72% |

33% |

|

Have an emergency fund |

76% |

36% |

|

Feel financially secure |

65% |

26% |

|

Have good clarity on how much they can afford now vs. save for later |

83% |

58% |

|

Think they will be financially prepared for retirement |

82% |

50% |

|

Have taken a step to address possibility of outliving life savings |

86% |

53% |

|

Have a specific plan to pay off debt |

77% |

46% |

|

Have inflation factored into financial plan |

73% |

46% |

|

Have plan to address health care costs in retirement |

72% |

42% |

|

Will have enough to leave behind an inheritance or charitable gift |

75% |

39% |

All investments carry some level of risk, including loss of principal invested. No investment strategy can assure a profit and does not protect against loss in declining markets.

Read the 2024 Planning & Progress Study – Value of an Advisor

As younger generations anticipate the $90 trillion “Great Wealth Transfer” predicted by financial experts, a minority of Americans may actually receive a financial gift from their family members. Just 26% of Americans expect to leave behind an inheritance.

|

Do you expect to leave an inheritance (or give a gift / donation to a charitable organization? |

|||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Yes |

26% |

36% |

28% |

22% |

22% |

|

No |

50% |

36% |

47% |

56% |

55% |

|

Not sure |

24% |

27% |

25% |

22% |

23% |

The study finds a considerable gap exists between what Gen Z and Millennials expect in the way of an inheritance and what their parents are actually planning to do.

One-third (32%) of Millennials expect to receive an inheritance (not counting the 3% who say they already have). But only 22% each of Gen X and Boomers+ say they plan to leave a financial gift behind.

For Gen Z, the gap is even wider – nearly four in ten (38%) expect to receive an inheritance (not counting the 6% who say they already have). But only 22% of Gen X and 28% of Millennials say they plan to leave a financial gift behind.

Based on plans alone, the generation that may see a larger wealth inheritance is Generation Alpha, given that more than a third (36%) of Gen Z say they plan to leave a financial gift behind.

|

Do you expect to receive money / assets as part of an inheritance(s)? |

|||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Yes |

25% |

38% |

32% |

28% |

11% |

|

I already have and don’t expect any more |

10% |

6% |

3% |

8% |

22% |

|

No |

53% |

38% |

49% |

54% |

62% |

|

Not sure |

12% |

18% |

17% |

10% |

5% |

Among those expecting to receive an inheritance, half (50%) consider it “highly critical” or “critical” to their long-term financial security. For Millennials it’s even more – 59%.

|

How critical to your long-term financial security or retirement is the inheritance that you're expecting? |

|||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

CRITICAL (NET) |

50% |

54% |

59% |

46% |

30% |

|

Highly critical. Without receiving an inheritance, I won't achieve long-term financial security or be able to retire comfortably. |

17% |

13% |

26% |

14% |

9% |

|

Critical. Without receiving an inheritance, I may not achieve long-term financial security or be able to retire comfortably. |

33% |

41% |

33% |

33% |

21% |

|

NOT CRITICAL (NET) |

50% |

46% |

41% |

54% |

70% |

|

Not critical. I'll achieve long-term financial security and retire comfortably with or without receiving an inheritance. |

43% |

41% |

35% |

48% |

54% |

|

Not critical. I'll never achieve long-term financial security or retire comfortably with or without receiving an inheritance. |

7% |

5% |

5% |

5% |

16% |

However, Gen Z has the greatest expectations for the impact of an inheritance on their retirement strategy. This generation expects the gift would cover 10% of their retirement funds.

|

Among the following, what percentage of your overall retirement funding do you expect each to deliver? |

|||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

401K or other retirement account |

29% |

26% |

31% |

33% |

24% |

|

Social Security |

26% |

13% |

18% |

27% |

40% |

|

Personal savings or investments |

23% |

27% |

24% |

20% |

22% |

|

Support from spouse / partner |

8% |

11% |

10% |

7% |

6% |

|

Other |

6% |

7% |

6% |

5% |

5% |

|

Inheritance |

6% |

10% |

6% |

6% |

2% |

|

Support from children |

3% |

6% |

4% |

3% |

1% |

A Very Meaningful Money Move for Some – and They’re Aiming to Help Their Kids

Among those expecting to leave an inheritance, two-thirds (68%) say it is either their “single most important financial goal” or is “very important.” Interestingly, it is more of a priority for younger adults than older with 75% and 81% of Gen Z and Millennials respectively saying it is either their single most important financial goal or very important, versus 65% of Gen X and 46% of Boomers+ who say the same.

|

How important of a financial goal is it for you to leave something for your kids / the next generation? |

|||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

It is my single most important financial goal |

17% |

14% |

22% |

18% |

11% |

|

Very important |

51% |

61% |

59% |

47% |

35% |

|

Somewhat important |

20% |

21% |

13% |

22% |

25% |

|

Not that important |

6% |

1% |

2% |

7% |

14% |

|

Not at all important |

7% |

2% |

3% |

6% |

14% |

Far and away, most people who expect to leave an inheritance plan to give it to their children and grandchildren.

|

To whom do you, or would you, expect to leave your inheritance and / or charitable gift/donation? |

|||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Children/Grandchildren |

71% |

69% |

71% |

74% |

70% |

|

Spouse |

42% |

53% |

44% |

37% |

36% |

|

Charitable organizations / causes / religious institutions |

35% |

38% |

29% |

30% |

43% |

|

Extended family members |

27% |

34% |

28% |

23% |

21% |

|

Friends |

13% |

24% |

16% |

4% |

7% |

|

Not sure |

2% |

2% |

1% |

3% |

1% |

However, the research finds nearly half (47%) of Boomers+ who expect to leave an inheritance or gift have not talked to family about their financial plans. More than a third of Gen X (38%) say the same.

Transfer Troubles and Solutions

Six in 10 American parents say their children do not value financial responsibility at the same levels that they do. And among them, more than half (52%) are concerned that their variance in values could negatively impact the family’s assets from one generation to the next.

Additionally, the research finds that four in ten Boomers+ (40%) and two-thirds of Gen X (65%) do not have a will. Among the primary reasons: people think they don't have enough assets, they’re too young, it's complicated and awkward to think about, and they’re uncertain about where to leave their assets.

|

Do you have a will? |

|||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Yes |

38% |

20% |

27% |

35% |

60% |

|

No |

62% |

80% |

73% |

65% |

40% |

|

Why don't you have a will? Please select all that apply. |

|||||

|

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

|

Don't have enough assets. |

34% |

25% |

36% |

37% |

37% |

|

Too young. |

31% |

74% |

38% |

10% |

2% |

|

It's complicated and awkward to think about. |

17% |

12% |

17% |

18% |

22% |

|

It's depressing to plan for the end of life. |

17% |

17% |

19% |

19% |

13% |

|

Unsure of who / what to leave assets to. |

17% |

19% |

18% |

16% |

17% |

|

Other |

7% |

2% |

6% |

11% |

12% |

|

Not sure |

14% |

6% |

12% |

18% |

20% |

One thing most Americans do feel comfortable passing along: financial insights. Three in four parents (76%) say they would feel comfortable formally including their teenage or young adult children in their annual meeting with their financial advisor. When asked to select the primary reasons why, most saw the value in “teaching / instilling in children good financial habits” (71%) and “introducing them to financial planning concepts” (58%).

Just one-third (32%) of American millionaires consider themselves “wealthy” and nearly half (48%) believe that their financial plans need improvement.

Rather than feeling rich, American millionaires – those with at least $1 million in investable assets – are far more likely to exhibit feelings of financial clarity and preparedness than the general population.

|

|

HNW Individuals ($1M+ in Investable Assets) |

General Public |

|

I have good clarity on exactly how much I can spend now vs save for later |

87% |

66% |

|

I know how much money I will need to retire comfortably |

77% |

44% |

|

I expect to be financially prepared for retirement when it comes |

87% |

54% |

|

I have a long-term financial plan that factors for up and down economic cycles over time |

84% |

52% |

|

I consider myself a disciplined financial planner |

78% |

45% |

In addition, millionaires are much more likely to work with a financial advisor (69%), more than double the amount of the general population (33%). The study also found that millionaires who have a financial advisor feel even clearer and more confident in their financial future than millionaires who do not consult with a financial expert.

|

Behaviors and beliefs among American millionaires |

||

|

|

With an advisor |

Without an advisor |

|

I know how much money I will need to retire comfortably |

81% |

70% |

|

I have a good understanding of how inflation could impact my retirement and have factored that into my financial plans |

83% |

70% |

|

I have a good understanding of how drops in the stock market could impact my retirement and have factored that into my financial plans |

88% |

75% |

|

I have a plan to address healthcare costs in retirement. |

83% |

69% |

|

I have a good understanding of how taxes could impact my retirement and have factored that into my financial plans |

80% |

67% |

|

When thinking about my overall retirement savings, I account for how much I will have to pay in taxes |

66% |

49% |

Almost eight in 10 American millionaires are “self-made”

Nearly 80 percent (79%) of American millionaires say their net worth was “self-made,” whereas 11% say they inherited their wealth and 6% say they came into it through a windfall event like winning the lottery. Moreover, 78% of millionaires describe themselves as “disciplined financial planners,” while just 45% of the general population agrees.

American millionaires are also more focused on creating inter-generational wealth than the general population, according to the research.

|

|

HNW Individuals ($1M+ in Investable Assets) |

General Public |

|

I have a will |

71% |

38% |

|

I have taken steps to address the possibility of outliving my savings |

84% |

62% |

|

I have had a conversation with family about my inheritance plans |

67% |

55% |

Wealthy Americans trust financial advisors most, by far

American millionaires put a high level of trust in financial advisors, far more than any other source.

|

Most trusted source of financial advice |

HNW Individuals ($1M+ in Investable Assets) |

General Public |

|

Financial advisor |

59% |

33% |

|

Family member |

6% |

16% |

|

Spouse / partner |

9% |

12% |

|

Business news |

7% |

5% |

|

Friend |

3% |

4% |

|

Online financial influencers and social media sites (e.g., Reddit, TikTok) |

4% |

4% |

|

Trade associations (e.g., AARP) |

3% |

2% |

|

Local news |

1% |

2% |

Impact of taxes is top “burning question”

The #1 “burning question” that millionaires have about retirement, according to the research, is: “How will taxes impact me?” That comes in ahead of, “How much money will I need to retire comfortably?” and “Is it possible I could outlive my savings?” – which rank #2 and #3, respectively.

Accordingly, six in ten (61%) millionaires say they have a plan to reduce the taxes they will owe on their retirement savings. They include:

|

|

HNW Individuals ($1M+ in Investable Assets) |

|

Making withdrawals strategically from traditional and Roth accounts to keep yourself in a lower tax bracket |

44% |

|

Using a mix of traditional and Roth retirement accounts |

37% |

|

Making charitable donations strategically, for instance taking advantage of bunching itemized deductions |

27% |

|

Using a Health Savings Account (HSA) or other tax-advantaged healthcare account |

24% |

|

Using products like permanent life insurance or annuities for their tax benefits |

24% |

|

Making Roth conversions prior to taking RMDs or Social Security |

23% |

|

Using qualified charitable distributions from an IRA |

22% |

|

Making contributions to other tax-advantaged accounts like a 529 |

17% |

|

Using the basis paid into the cash value of permanent life insurance to keep yourself in a lower tax bracket |

19% |

|

Taking advantage of a Qualified Longevity Annuity Contract (QLAC) to set aside funds for later in retirement |

17% |

With retirement dreams on the horizon, Gen X women on average believe they will need more than $2 million to retire comfortably, more than any other generation of women. Meanwhile, the average retirement savings goal among Boomer+ women is seven-figures smaller: $902,000. But arguably, the largest generational difference between women is one rooted in attitudes and beliefs: six in 10 (60%) Gen Z women think they will be financially prepared to retire when the time comes, while just 40% of Gen X women agree.

|

In a specific dollar amount, how much do you think you will need to save in order to retire comfortably? |

||||

|

Women (average) |

Gen Z Women |

Millennial Women |

Gen X Women |

Boomers+ Women |

|

$1.5 million |

$1.2 million |

$1.5 million |

$2.1 million |

$902K |

Gen X women report being furthest away from their retirement goals, having $95,000 on average saved for retirement.

|

|

Women (Average) |

Gen Z Women |

Millennial Women |

Gen X Women |

Boomers+ Women |

|

Amount saved for retirement currently |

$80K |

$16K |

$60K |

$95K |

$101K |

|

Gap between retirement goal and current savings |

$1.4M |

$1.2M |

$1.4M |

$2.0M |

$801K |

Perhaps unsurprisingly, many Gen X women described themselves as financially insecure, with 42% saying they do not feel secure. Moreover, 10% of Gen X women say they are currently unemployed and unable to work due to an injury or an illness.

Retirement uncertainty and insecurity

Only one-third (36%) of women indicate they know how much money they will need to retire comfortably. And nearly one quarter (24%) say they have less than 1x their current annual income saved for retirement.

|

|

Total Men |

Total Women |

Gen Z Women |

Millennial Women |

Gen X Women |

Boomer+ Women |

|

I know how much money I will need to retire comfortably. |

52% |

36% |

29% |

34% |

35% |

42% |

|

I have a plan to address healthcare costs in retirement. |

55% |

42% |

37% |

41% |

36% |

50% |

|

I will have enough to leave behind an inheritance or gift to loved ones and/or charitable causes I care about. |

49% |

38% |

41% |

35% |

34% |

43% |

|

I have a plan to address long-term care needs in retirement. |

45% |

35% |

34% |

37% |

30% |

36% |

|

I have planned for the possibility that I could outlive my savings. |

48% |

31% |

33% |

35% |

26% |

30% |

Generation Zeal steps forward with confidence

Generation Z women say they aim to retire nine years sooner than Boomer+ women (by age 62 vs. 71). They also expect to pay off their college loans a full decade earlier than their Millennial counterparts (by age 33 vs. 43). These feelings of confidence also extend to their retirement planning: six in 10 (60%) Gen Z women think they will be financially prepared to retire when the time comes, while just 40% of Gen X women agree.

Younger women are also more likely than women in other generations to report that their household income is growing faster than or keeping pace with inflation.

|

Is your household income growing faster, slower or is it on pace with inflation? |

|||||

|

|

Women (Average) |

Gen Z Women |

Millennial Women |

Gen X Women |

Boomers+ Women |

|

Faster or on pace |

36% |

40% |

39% |

33% |

33% |

|

Slower |

54% |

42% |

51% |

58% |

58% |

|

Not sure |

11% |

18% |

10% |

9% |

9% |

They’re also some of the most confident consumers: 57% of Gen Z women say they will spend more or the same in 2024 while just 37% expect to spend less.

Advice for the ages

The study finds that younger women are more inclined than older women to put their trust in family members and spouses when it comes to getting financial advice. Among older adult women, their most trusted source of financial advice is definitively with advisors. That said, one quarter (26%) of women have not received advice from anyone, and for Boomer+ women the number is even higher – 32%.

|

Most trusted source for financial advice |

Total Women |

Gen Z Women |

Millennial Women |

Gen X Women |

Boomer+ Women |

|

Financial advisor |

30% |

24% |

23% |

31% |

37% |

|

Family member |

17% |

34% |

17% |

14% |

12% |

|

Spouse/partner |

15% |

14% |

21% |

16% |

10% |

|

Other Source (i.e., Online financial sites, local news, business news) |

12% |

13% |

16% |

12% |

9% |

|

I have not received advice from anyone |

26% |

15% |

23% |

27% |

32% |