Planning & Progress Study 2020

The 2020 Planning & Progress Study, an annual research study from Northwestern Mutual, explores U.S. adults’ attitudes and behaviors toward money, financial decision-making, and the broader issues impacting people’s long-term financial security.

Even before the COVID-19 outbreak led to a spike in unemployment and declines in the stock market and broader economy, 33% of Americans were already within three missed paychecks of having to either borrow money or skip bills.

These are the first set of findings from the 2020 Planning & Progress Study, an annual research project commissioned by Northwestern Mutual that explores Americans’ attitudes and behaviors toward money, financial decision-making, and broader issues impacting people’s long-term financial security.

From a financial perspective, the research shows people view cash and money market funds (45%) as their best defense against economic uncertainty and market volatility, with stocks, bonds and life insurance in a three-way tie for second (all at 18%). At the same time, nearly a third (31%) of people are unsure of what their best financial defense should be at a time of uncertainty and volatility.

Critical to plan

The research shows that 71% of Americans say their financial planning needs improvement. That said, there are some encouraging signs in the data about people’s instincts to plan and the discipline they bring to it.

- 22% consider themselves “highly disciplined” planners – They know their exact goals, have developed specific plans to meet them, and rarely deviate from those plans

- 39% consider themselves “disciplined” planners – They know their exact goals, and have developed specific plans to meet them, but those plans can deviate at times because they don’t always stay on top of them

- 29% consider themselves “informal” planners – They have a general sense of their goals and how to meet them, but they do not have a formal plan in place

- 10% are not planners and have not established any goals

There’s also a sizable percentage who say they enjoy planning, and a plurality that see it as necessary even if it’s not their favorite thing to do. That said, 3 in 10 Americans struggle with confronting their financial situation, and given the economic downturn it’s reasonable to expect that number could go up. Specific numbers regarding how people feel about financial planning were as follows:

- Excited and inspired. Love to do it! (29%)

- Not my favorite thing in the world but know it needs to get done – like a medical check-up (37%)

- Worried, nervous about confronting the financial details of my life (16%)

- Prefer to not deal with it until I absolutely have no choice (6%)

- Frustrated, annoyed with my financial situation (8%)

- Skeptical about the value of planning (3%)

Benefits of getting professional help

The study shows that 29% of Americans work with an advisor and 65% do not.

Interestingly, when asked who people trust the most for financial advice, the #1 response was themselves (28%), followed by a financial advisor (24%) then a family member (13%). Meanwhile, 15% said they don’t get financial advice from anyone.

Download the 2020 Planning and Progress Study - Fragile Financials

The latest findings from Northwestern Mutual’s 2020 Planning & Progress Study reveal that among Americans who carry debt, a third (33%) of their monthly income goes toward paying it off, exclusive of mortgages. Those with debt report having $26,621 on average, and 13% of Americans expect to be in debt the rest of their lives.

Among U.S. adults carrying debt, 58% say it has a substantial or moderate impact on their ability to achieve long term financial security. Additionally, many report that debt impacts their ability to reach major financial milestones:

- 36% delayed significant purchases

- 29% delayed saving for retirement

- 18% delayed buying a home

- 8% delayed having children

- 7% delayed marriage

Signs of Progress…Before the Storm

There are some positive indications in the data that suggest Americans have been making progress in their ability to manage and reduce debt over the last several years. But it’s important to note that this year’s findings were collected just prior to the steepest impacts of the COVID-19 outbreak. Even so, it is worth noting the trend lines:

- The total average debt among those who have it has been slowly declining over the years – from just over $38,000 in 2018 to $29,800 in 2019 to $26,621 this year

- Of those with some debt, over two thirds (67%) have a specific plan to pay it off

- Over a quarter (26%) of Americans report having no debt

The Credit Card Crunch

Credit card bills (22%) and mortgages (21%) are the leading sources of debt for Americans. Car loans (8%) and personal education loans (8%) came in as the next highest sources of debt.

Of the 42% Americans who report holding credit card debt, the average amount is $5,400. Of that debt, over half (52%) went toward paying for absolute necessities like rent, utilities and groceries; 36% was for discretionary expenses such as entertainment, vacations, or dining out; and 11% was used for educational expenses. The study also found:

- 30% of U.S. adults either always or often pay the minimum payment on their credit card bills, just covering the interest without paying down any principal

- 33% pay greater than a 15% interest rate on their cards, and 9% don’t know what interest rate they’re paying

- 12% expect to be in credit card debt between 11 and 20 years, and 7% expect their credit card debt to last more than 20 years

There also appears to be a bit of a learning curve when it comes to credit card usage. More than six in ten Americans with credit card debt (61%) said that if given the choice, they would have changed the way they used credit cards in the past.

- 56% would have limited their use of credit cards to primarily cover necessities

- 37% would have gained a better understanding of interest rates

- 23% would have waited to get a card until they really needed one

Download the 2020 Planning and Progress Study - Debt + Credit Cards

Market volatility and the economic downturn prompted by the COVID-19 pandemic has spurred a significant financial response among Americans and a whirl of proactivity, according to the latest findings from Northwestern Mutual’s 2020 Planning and Progress Study.

For some, the crisis has led them to see the importance of having a financial plan. Among U.S. adults age 18 and older, 15% say they didn’t have a plan before the pandemic but now have been prompted to develop one.

For those who already had plans in place, the crisis has prompted many to adjust course. One-fifth (20%) of Americans say they have revisited their financial plans and made significant adjustments in response to the pandemic and its subsequent economic impact.

Gen X, Millennials and Gen Z are seeking help

The study found that one-fifth or more of each Gen X (19%), Millennials (22%) and Gen Z (22%) say they didn’t have a financial advisor before the pandemic but will seek to start working with one now.

Additionally, the younger generations stand out for how proactive they have been in response to the economic downturn:

- Nearly three out of 10 (28%) Millennials have revisited their plans and made significant adjustments, more than any other generation.

- One-fifth (19%) of Millennials and one-quarter (25%) of Gen Z didn’t have a financial plan before the pandemic but are looking to develop one now.

Bruised but not broken

When asked how financially secure people feel on a 10-point scale, the average rating was 6.1, compared to 6.7 before the pandemic. Taking a closer look, the numbers reveal shifts at both the higher and lower ends of the scale:

- 35% rate themselves as financially secure (between an eight and 10), which is down from the 45% among these same participants who say they were financially secure prior to the pandemic.

- Those who rated themselves between one and three, or not financially secure, jumped to 19% compared to 12% pre-pandemic.

Cautious but resilient

The pandemic has had a real impact on people’s financial situations, and in turn their decision-making and behaviors. Overall, Americans are showing a combination of caution and resilience in the face of adversity.

More than four in 10 (42%) Americans say they’re less willing today to take risks with their finances in an effort to protect their assets, compared to just 16% who say they’re more willing to take risks with their finances in an effort to pursue higher returns.

Additionally, a significant number of Americans (45%) have taken steps to cover their regular living expenses:

- 25% have dipped into personal savings or emergency funds (excluding retirement accounts)

- 14% have borrowed money from family or friends

- 10% have dipped into retirement account/savings (e.g., 401k, IRA, etc.)

- 8% have applied for a loan from a financial lender

- 8% have sold investments to raise cash (stocks, bonds, mutual funds, etc.)

- 6% have used the cash value of a life insurance policy

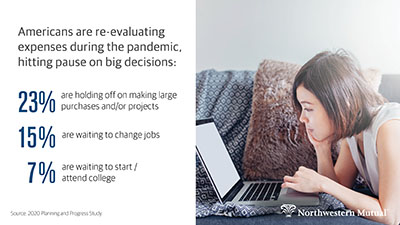

Many Americans have also re-prioritized and re-evaluated their critical vs. discretionary expenses, and hit pause on some big decisions:

- 23% have postponed large purchases or projects (e.g., car purchase, home remodeling, etc.)

- 15% have postponed changing jobs/searching for a new job

- 11% have postponed buying or building a new home

- 9% have postponed starting a business

- 7% have postponed starting / attending college

- 5% have postponed retiring / leaving the workforce

- 5% have postponed getting married

- 3% have postponed having / adopting children

Finally, the pandemic has prompted many Americans to reconsider their views of life insurance’s role as part of a holistic financial plan, with nearly four in 10 (37%) saying they now see an increased importance for owning it.

Download the 2020 Planning and Progress Study - Americans' Financial Response to COVID-19

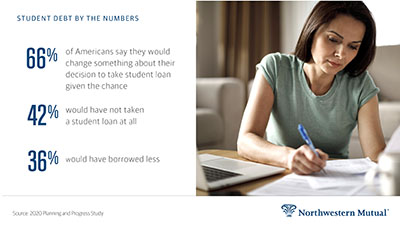

The latest set of findings from Northwestern Mutual’s 2020 Planning & Progress Study highlights the impact that student debt can have on a financial plan. Among U.S. adults aged 18+ who hold student debt, the average amount is $24,155. The study also finds that 42% of Americans with student debt say that if they had to do it over, they wouldn’t take a student loan at all.

Debt Report Card

The 2020 Planning & Progress Study finds that about 1 in 4 Gen Z (25%) and Millennials (24%) hold student debt compared to 16% of Gen Xers. Among those with student debt, younger generations have lower averages than Gen X:

- Gen Z – $15,798

- Millennials – $21,367

- Gen X – $34,075

The findings also show that the younger generations appear to be more optimistic about how long they expect to hold their student debt. Nearly half of both Gen Z (46%) and Millennials (47%) expect to pay off their student debt within one to five years, compared to 33% of Gen Xers. In contrast, 11% of Americans with student debt say they will be holding that debt for more than 20 years.

Back to School

Two in five Americans (40%) say they did not have a proper understanding of the implications of taking on student debt when they elected to seek a loan, according to the research. Additionally, two-thirds (66%) say they would change something about their decision given the chance:

- Over four in 10 (42%) say they would have not taken a student loan at all

- Over one-third (36%) say they would have borrowed less

Among generations, Gen X and Millennials are more likely than Gen Z to say they would not have taken a loan at all (41%, 44% and 22%, respectively), while more than half of Gen Z say they would have borrowed less (57%).

Family Affair

Those with student loan debt also report receiving significant support from family members.

Nearly one in six (16%) say their parents help to pay off their student debt. The younger generations report their parents help at slightly higher rates, with 31% of Gen Z and 19% of Millennials.

In addition, 25% of Gen Xers and 22% of Millennials say their spouse/partner contributes to paying off their student loan debt.

Download the 2020 Planning and Progress Study - Student Debt

New findings from Northwestern Mutual’s 2020 Planning & Progress Study reveal that 84% of U.S. adults aged 18+ expect the COVID-19 pandemic and subsequent economic downturn will have an impact on their ability to achieve long term financial security. Six in 10 (59%) say that impact will be moderate or high.

At the same time, confidence in a robust recovery – both personally and for the country – is strong. The study found:

- 83% of Americans believe they will ultimately achieve long term financial security. Among them, 44% say it will be in a year or less and 32% say between two to five years.

- 76% are confident the country will return to full employment. Among them, 47% say it will be in a year or less and 39% say between two to five years.

- 79% are confident the country will return to economic growth. Among them, 47% say it will be in a year or less and 38% say between two to five years.

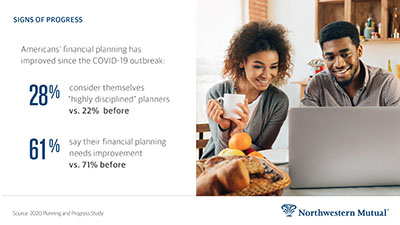

Financial Discipline has Improved

The study shows that financial habits and discipline have improved since the COVID-19 outbreak.

More than seven in 10 (71%) Americans said that their financial planning needed improvement prior to the pandemic. Today, that number has dropped to 61%.

Additionally, people indicate their financial discipline has improved:

- Nearly three in 10 (28%) Americans consider themselves “highly disciplined” financial planners today, compared to 22% who said the same before the pandemic. “Highly disciplined” is defined as knowing your exact goals, developing specific plans to meet them, and rarely deviating.

- One quarter (25%) of Americans consider themselves “informal” financial planners today, compared to 29% who said the same before the pandemic. “Informal” is defined as having a general sense of your goals and how to meet them, but not having a plan in place.

Covering Living Expenses

While people’s long-term view is distinctly positive, there are still sizable numbers in the position of having to address near-term financial needs during an economic downturn.

The findings reveal that over one-third (38%) of Americans have had to take steps to cover their living expenses since the pandemic:

- 19% have dipped into personal savings or emergency funds

- 13% have borrowed money from family or friends

- 9% have dipped into retirement savings (401k, IRA, etc.)

Additionally, over a quarter (26%) of U.S. adults have taken advantage of payment deferral plans, including those for mortgages (8%), rent (8%), credit card bills (8%), utilities (7%), student loans (6%), and auto loans (5%).

Download the 2020 Planning and Progress Study - Americans’ Resilient Response to COVID-19

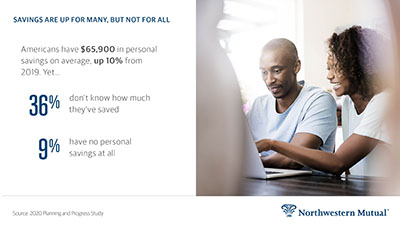

New research from Northwestern Mutual’s 2020 Planning & Progress Study reveals that the savings rate among American adults aged 18+ is up, and it’s likely the result of their concerns about what could come next financially and economically at this extraordinary moment in history.

The study found that on average, U.S. adults aged 18+ have $65,900 in their personal savings (excluding funds specifically earmarked for retirement like a 401(k), IRA, etc.). That is a 10% increase from the $59,737 average reported in 2019.

This aligns with U.S. Bureau of Economic Analysis data[1] which shows the savings rate – the portion of monthly income that households are saving – hit a record 33.7% in April and has hovered around 20% in the following months. Before the pandemic, the savings rate was approximately 7.5%.

Overall, more people feel financially secure (37% between 8–10 on a 10-point scale) than insecure (16% between 1–3). But that has dropped somewhat from pre-pandemic levels when 44% reported between 8–10 on the financial security scale. Additionally and importantly, there is a substantial minority that are clearly financially vulnerable:

- Nearly one in 10 (9%) Americans have no personal savings at all

- Over one-third (36%) don’t know how much they have saved

Preparing for what lies ahead

While savings are up overall, people have significant concerns about what could take place over the coming months and years, and how it might impact their finances.

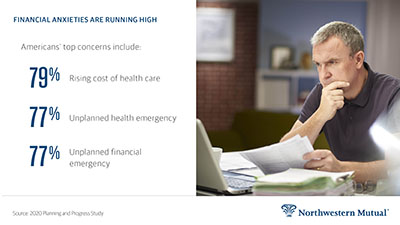

Among a list of financial concerns, Americans cited the rising cost of health care as the top worry with nearly eight in 10 (79%) reporting feeling some level of anxiety (either high, moderate, or low) about it.

Other reasons people cited feeling financially anxious include:

- Unplanned health emergency – 77%

- Unplanned financial emergency – 77%

- Their income – 76%

- Inability to afford healthcare – 68%

- Level of debt – 60%

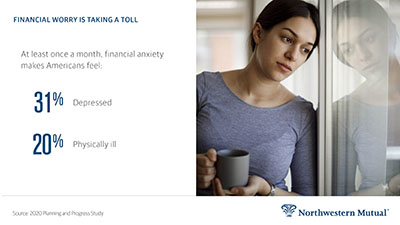

Nearly one-third (31%) of U.S. adults say financial anxiety causes them to feel depressed at least once a month. Two in 10 (21%) say it impacts their relationship with a partner/spouse at least once a month; and one-fifth (19%) say it has a monthly impact on their job performance.

As a starting point, try out the following for those who are feeling anxious about their financial futures:

- Review spending habits: It can be hard to manage or mitigate financial anxiety if people don’t have a clear sense of their spending behaviors.

Nearly half (49%) of U.S. adults say they don’t have great clarity on exactly how much they can afford to spend now vs how much they should be saving for later. As a result, 27% say they hold back on spending while 22% say they spend and hope they’ve saved enough.

Taking a step back and getting a solid understanding of where money is flowing can help individuals make more informed decisions.

- Refine or create a budget, with short- and long-term goals: Identify what expenses are critical and factor in both near-term and long-term obligations.

At times of financial stress, human behavior can become highly acute. The research shows that one in five (20%) people say they are thinking about or actively planning their finances only on a week-to-week or day-to-day basis.

That’s understandable but it’s important to not lose sight of long-term objectives. A structured plan can help to make sure near-term needs are addressed while long-term goals – like saving for retirement – don’t get sidelined or put on hold.

- Consider seeking outside advice: Some people are reluctant to seek professional help because they either assume it’s only for the wealthy or it’s viewed as an unnecessary expense when finances are a concern. Yet it’s at challenging times when professional help can be most important. A financial professional can help provide more clarity and get people back on track if they’ve drifted or lost their way.

[1] U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT

Download the 2020 Planning and Progress Study - Financial Security and Emotions

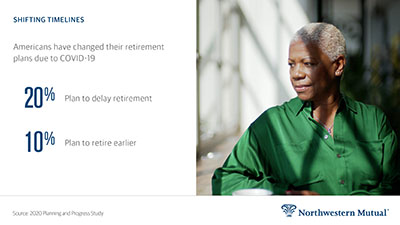

The economic impact of the COVID-19 pandemic has changed the retirement timeline for 30% of Americans, according to research from Northwestern Mutual’s 2020 Planning & Progress Study. The study finds that 20% of U.S. adults age 18+ plan to delay retirement beyond what they expected, while 10% plan to accelerate their timelines and retire earlier than anticipated.

Millennials are the most likely generation to move up their planned retirement date, with nearly one in six (15%) saying they would accelerate their plans. This compares to less than one in 10 among Gen Z (8%), Gen X (6%) and Boomers (4%). Meanwhile, Gen X (25%) is the most likely generation to say the pandemic has caused them to push back their planned retirement date, followed by Gen Z (22%), Millennials (19%), and Boomers (14%).

When asked what age people expect to retire, Millennials indicated the earliest target date, nearly seven and a half years younger than Baby Boomers:

- Gen Z - 62.5

- Millennials - 61.3

- Gen X - 63.2

- Boomers - 68.8

Retirement Obstacles

The study finds that the greatest obstacles to financial security in retirement have flip-flopped during the pandemic. Before COVID-19 began to spread widely, lack of savings (42%) was the top obstacle followed by healthcare costs (38%) and the economy (34%). Now it is the economy (49%) followed by lack of savings (33%) and healthcare costs (32%).

Findings also reveal that people are relying heavily on Social Security as a funding source during retirement but don’t have great faith it will actually be there when they need it. Social Security ranked as the top source of retirement funding, accounting for an average of 27.2% of Americans’ overall retirement funding. But one-fifth (20%) of people believe it is not at all likely Social Security will be there when they’re ready to use it.

Working Longer

One in five (21%) U.S. adults expect to work past the traditional retirement age of 65. Among those who do, nearly half (45%) say it’s because of necessity and 55% say it’s because of choice.

Taking a closer look at those who plan to work out of necessity, the top reason cited was not having enough saved to retire comfortably at 60%. Other top reasons include:

- I do not feel like Social Security will take care of my needs – 58%

- I am concerned about rising costs like healthcare - 49%

- I had an unexpected situation arise that has cut into my retirement savings - 20%

For those who plan to work past the age of 65 by choice, the top reason cited by nearly half (49%) is that they enjoy their job/career and would like to continue. Other reasons include:

- I want additional disposable income - 43%

- It is a social outlet that will help me stay active/prevent boredom - 34%

- I want to do something that will let me give back to the community - 21%

Download the 2020 Planning and Progress Study - Work + Retirement